Amidst a slew of recent Golden Visa program closures across Europe, the continent’s top residency by investment program is more popular than ever – AND its imminent price increase for certain areas has been delayed.

In today’s episode, we take a look at some of the factors contributing to the program’s success…

A look at Europe’s most popular Golden Visa program (and why you should consider it)

Frequently promoted internationally as “a giant open air museum”, Greece is a truly fascinating country. It is the cradle of democracy, and birthplace of Western civilization.

The country offers an excellent climate, healthy, sumptuous food and a relaxed, welcoming vibe. It’s a wonderful place to spend time; especially if you avoid the crowds of dusty Athens and the throngs of Instagram “influencers” in Santorini.

Plus it’s part of the EU and the Schengen Area, so residents enjoy access to both.

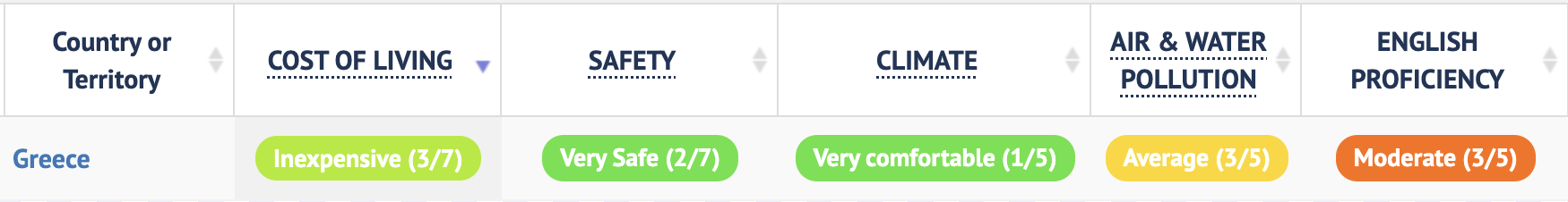

The country’s cost of living is low — and the cost of housing, currently, is exceptionally affordable:

The low cost of living aspect, in particular, caught our attention, especially because the Greek Golden Visa program grants residency in return for a real estate investment of just €250,000 (~$274,000)…

Quick Greek Golden Visa program facts

- Top-selling EU Golden Visa program – over 28,000 residency permits issued to date

- Currently the most affordable property-based option (€250K – tied with Latvia)

- No minimum in-country presence requirement (0 days per year)

- Residency permits issued within 2-3 months

- Multiple properties with the combined value of €250K can be used to apply.

Moreover, given that the Portuguese government has decided to shutter their (until now) acclaimed Golden Visa program, the option to still get a property-based Plan B in Southern Europe should not be squandered:

If getting a relatively affordable, super flexible EU Plan B in place is on your to-do list, then now is NOT the time to vacillate. (More on that in a bit.)

But first, let’s take a look at the program’s investment options below:

| Greek Golden Visa Program Summary | |||

|

Program Investment Options |

Additional Costs | Minimum Stays |

Does it lead to citizenship? |

€250k (~$274K): Real Estate. (Increasing to €500k (~$548K) in several of the country’s more attractive locations later in 2023.) OR; €400K (~$438K): Term Deposit, or investment in VC Funds, Greek Treasury Bonds, Mutual Funds or Alternative Investment Funds, etc. OR; €800K (~$877K): Corporate Bonds or Shares | Additional 24% VAT on new construction projects, OR; Transfer tax of 3% on other properties; Service provider fees (variable) Legal fees (variable). | None | Yes, after 7 years of residency, along with a number of important requirements we discuss in more detail below. (Greece allows dual citizenships.) |

Caveat emptor: Considering the paltry financial situation of the Greek government and the country’s banking sector, we cannot recommend you pursue anything other than the real estate option. And if you do, make sure you understand all the risks associated with your investment very well…

What makes the Greek program so compelling?

The Greek Golden Visa has two major factors going for it:

First, its low minimum investment requirement, and second, the fact that you don’t need to visit Greece to keep your residency active.

As long as you maintain your investment, you can renew your visa indefinitely every five years.

The downside — a Greek passport, in practice, is hard to obtain. At the time of naturalization, you’ll need to be fluent in the Greek language, and be highly knowledgeable regarding Greek culture and history.

And while you can renew your GV residency permit without living there a single day, it takes seven years of residency to become eligible for naturalization.

And during this time you cannot be absent for more than six months per year. Moreover, the Greek authorities will also be checking whether you paid Greek taxes during this period.

Greece: Another Golden Visa Program that’s going through changes…

To qualify for the Greek Golden Visa, applicants must purchase a property (commercial or residential) with a value of at least €250,000 (~$274,000). This is the lowest investment amount required among all programs in Europe (if you’re purchasing a property).

And combined with the general affordability of the Greek housing market, investors flooded the Greek GV program. This has fuelled sharp real estate price increases in the country’s main cities, and started making local real estate unaffordable for locals.

Just like in Portugal, this issue prompted the government to enact new restrictions (in Greek).

The minimum investment threshold will soon go up to €500,000 (~$548,000) for real estate purchases in certain parts of the country.

You now have until July 31 of 2023 (instead of April 30) to put down a 10% deposit on a property in these areas, otherwise you will have to pay double in some parts of Athens (namely North, Central and Southern Sectors of the city), Thessaloniki, Vari-Voula-Vouliagmeni, as well as the entire islands of Mykonos and Santorini.

You’ll still, however, have to complete the transaction inside of 2023.

If these areas are your preference, then you need to hurry up. Even though the price increase has been delayed by an additional three months, you will be running against the clock to identify and buy a suitable property…

Watch out for VAT charges on new RE projects…

Depending on the type of property you opt to purchase, additional VAT charges – a whopping 24%, to be exact – may apply. The good news however, is that the current center-right government decided to waive these charges on new properties until 2024.

This means that Greek real estate is now even cheaper for foreign investors.

And you can rent out your property for profit, with no restrictions.

A word on your tax situation in Greece

With a GV residency permit, you don’t have to live in Greece. But if you do decide to reside in Greece, you need to consider the country’s taxation. The good news is that in the past few years Greece enacted several important tax incentives.

For starters, they introduced a flat income tax rate of 7% for foreign pensioners who transfer their tax residence to the country.

Then, to attract wealthy individuals, the government announced a Non-Dom tax regime, allowing you to pay a flat tax rate of €100,000 (~$110,000) per year on any of your income derived outside of Greece. (You will also need to invest €500,000 (~$548,000) or more in the Greek economy, however. Real estate qualifies.)

And not to overlook employees and self-employed individuals, Greece also allowed a 50% discount on your income generated in Greece, making it a rather attractive place to relocate to.

NOTE: Sovereign Confidential members – remember that you have access to a deep-dive Black Paper on Europe’s Golden Visa programs, including Portugal, Spain, Greece, Cyprus, Latvia, Italy and Ireland.

In addition, you also have access to deep-dive reports on the above tax incentives and those found elsewhere across Europe.

The bottomline…

Having the option to live in Greece whenever you want – or need to – is the kind of optionality we can get behind. Greece offers a generous, streamlined, fast and predictable Golden Visa program.

And given the current low pricing, PLUS the option to buy any piece of property on the open market, it’s one the most compelling programs of its kind still remaining in 2023.

So if this is something you’re considering, don’t let this opportunity get away from you.

PS: Sovereign Confidential members – we have an exceptional legal supplier for this program, with offices based in both Athens and Thessaloniki. (AND they’ve got access to quality, available property stock, so get in touch if you’d like their details.)