Macleod: The Dynamics Driving The Dollar Down

Authored by Alasdair Macleod via GoldMoney.com,

This article examines the currency imbalances between US dollars and the other currencies and concludes that should foreign holders decide to reduce their dollar exposure, the consequences for its value would be dramatic.

The dollar’s problems should be laid at the door of the wishful thinkers who think the state knows better than free markets. It is that which has led to currency imbalances. Central banks attempting to manage economic outcomes by manipulating interest rates and “stimulating” economic activity have acted in defiance of Say’s law, which defines the relationship between production and consumption, and the true role of a medium of exchange.

By dismissing this fundamental truth, the US authorities have made a rod for their own backs.

Their determination to replace gold as the highest form of money with the fiat dollar has led to extraordinary levels of dollar accumulation about to be unleashed onto unsuspecting markets.

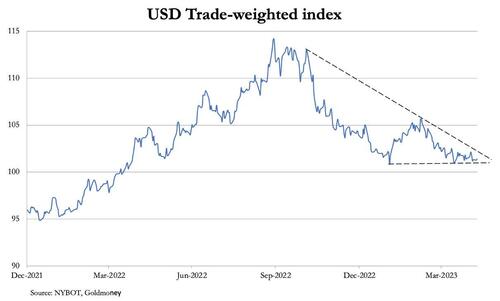

A break below 100.50 on the dollar’s trade weighted index will probably be the signal. It currently stands at 101.50.

Say’s law says it simplest

John Maynard Keynes did the world a disservice with his offhand dismissal of Say’s law. Consequently, economists have lost the true relationship between production and consumption. And we have lost our understanding of the true role of currencies as a medium of exchange. Nearly all our economic errors have flowed from this dismissal.

In order to understand the seriousness of it with respect to the dollar today, the denial of Say’s law is no less than a denial of the division of labour. Yet, plainly, the division of labour is the basis of all human economic activity. Without having something to sell, we cannot buy the things we need which we are unable to provide for ourselves efficiently or easily. Where we differ from other animals is that we develop our personal skills to maximise the value of our specialised production so that we can increase our wider consumption for the greatest relief of our needs and desires. Our individual skills are the key that provides our wealth. And it is the role of currency as a medium of exchange which allows us to turn our production into our consumption.

Several things follow from this truism. One is that if we reduce our total production, we reduce our total consumption, because the former leads to the latter. No, say the Keynesians, who put it the other way round. They say that if we reduce our consumption there will be a general glut of goods on the market and then prices will fall, leading to unemployment. The error is to not understand that first we must produce in order to consume, so that there cannot be a general glut, only changes in the level of productive output which are broadly matched by changes in overall consumption.

Surely, this can be easily understood even by non-experts. But this deliberate error — for that is what it can only have been — has led to a misunderstanding of the role of the medium of exchange. It provides the means to exchange goods of unequal value: for example, a cobbler makes shoes and boots, whose unit value will be greater than the individual food items he requires daily to feed his family. It also provides producers with the credit required to finance production, paying costs incurred before a final product is sold and creditors repaid.

This is the essence of trade. And so long as transacting individuals only produce to consume, the expansion and contraction of the sum total of money and credit purely in connection with that trade cannot alter their value in terms of goods and services generally. Not so, say Keynes’s macroeconomists, now joined in chorus by the monetarists. They claim that expansion of money and credit alters the general price relation. Both believe in manipulating credit to this end.

Again, a child should be able to understand the flaw in this argument. The general price relation is only altered when additional currency is introduced by central banks for purposes other than the credit required for the settlement of trade in free markets.

This is in defiance of the sole function of a medium of exchange, which is to act as the agent for turning our production into consumption. But it does mean that if excess currency accumulates in the form of credit additional to its use as a trade settlement medium, its purchasing power is undermined because it does not originate from the need to turn production into consumption. It is important to understand that it is this excess that changes the price relation, not changes in the level of credit per se. And this is the case with respect to international trade, where currency balances have accumulated.

When a foreigner holds unspent dollars, that person or entity can be said to be “owed” US domestic goods and services. This logically follows from the unbending precepts of Say’s law. But the majority of foreign owned dollars have actually been exchanged for product of a sort. On US Treasury TIC figures, approximately $24.5 trillion are invested in long-term US Treasuries, corporate bonds, and equities. These constitute incorporeal wealth and are therefore classed in the owners’ minds as assets, just as if they were corporeal wealth, such as property, farmland, livestock, and factories, which are similarly valued in dollars. All these assets represent consumption of the fruits of production.

It is the unspent dollars held in the correspondent banking system, together with short term Treasury and commercial bills instantly realisable, totalling some $7.2 trillion which represents the unspent balance of foreign production. It arises because foreigners have accepted dollars in payment for their goods and have yet to spend them on US goods and assets.

What are their alternatives? They can of course hang on to their dollars, spend them on US production (presumably by increasing their ownership of financial and non-financial assets valued in US dollars), sell them to acquire non-American production and assets, or exchange them for the ownership of their own or other currencies of account.

The altered character of the US economy

It will not have escaped the reader’s attention that over decades the US economy has reduced its production of corporeal goods relative to the incorporeal. This means that foreigners cannot buy much in the way of semi-manufactured and manufactured goods with their dollars, but overwhelmingly incorporeal assets in the form of securities and services. Accordingly, the US economy is said by some to have been hollowed out.

Putting services to one side, this means that by acquiring US securities, which have accumulated to a figure larger than US GDP, foreigners are committing to receive continuing dollar income streams. It is an important distinction from spending dollars on physical goods, which are not so immediately exposed to currency risk.

But it has been the long-term decline in interest rates driving bull markets which contributed to the accumulation of incorporeal, or credit-based assets by foreigners. And just as surely that the long-term decline in interest rates encouraged the accumulation of purely financial incorporeal assets, at some point the new trend of increasing interest rates will surely lead to an avalanche of foreign liquidation, not just of the assets themselves, but of the underlying dollars.

But there is a substantial overhang of dollars in foreign hands already, which according to the US Treasury is just over $7.2 trillion, representing about 40% of US bank deposits. Assuming for the moment that there is no official intervention, in aggregate those dollars can only be sold for foreign currencies and gold in possession of American citizens and businesses. But according to the US Treasury’s TIC figures, American ownership of foreign currency balances is only $632bn, and we can safely disregard ownership of the gold available to satisfy dollars sales by foreigners. Therefore, the ownership of dollars in foreign hands outnumbers the available foreign exchange by over eleven times.

Domestic owners of dollars widely believe that foreigners must hold onto dollars, because they are used to settle purchases of commodities, settle international trade, and to pay interest on dollar debt owed by foreigners. This is certainly true. But what happens if foreign holders of US financial assets begin to fear further rises in dollar interest rates? Pressure will mount for them to reduce their holdings in longer-term assets, realisable in dollars which adds to that eleven to one currency imbalance.

Partially offsetting the $24.5 trillion foreign ownership of long-term US financial assets is US ownership of foreign financial assets amounting to $14.5 trillion — an unfavourable balance though not so much as is the case with short-term deposits. But additionally, interest rate increases in the US have happened in advance of the other major currencies and if that relationship continues fixed-interest financial asset values in dollars will generally decline ahead of those in other currencies. Assuming this timing relationship holds, there is a risk that the resumption of a global bear market will undermine dollar assets first relative to the euro, yen, yuan, and pound — irrespective of their individual characteristics.

The problem for the dollar is heightened by a further factor. When foreigners liquidate dollar investments, they end up owning additional dollars to those already reflected in correspondent bank balances. These are likely to be sold down immediately for the diminishingly small pool of US owned foreign currencies and for gold. The situation is different for US residents holding foreign investments, the vast majority of which are held in American depository receipt (ADR) form. Consequently, an American investor does not have a foreign exchange transaction when selling these assets. Therefore, selling of foreign investments cannot be offset against foreign selling of US investments with respect to the consequences for exchange rates.

The one-sidedness of this situation is likely to become rapidly apparent when the dollar’s technical position is seen to deteriorate from current levels. The chart below shows the current position for the dollar’s trade weighted index.

The technical position suggests that this breakdown is set to occur soon, and that a breach of 100.50 (currently at 101.50) is likely to be the precursor for a significant further decline in the trade-weighted index.

If that happens, it is likely to be sudden.

Intervention by the Fed and US Treasury

The lack of US domestic ownership of foreign currencies makes it almost certain that a run on the dollar will be met by official intervention. The Fed is able to draw on swap lines with the other central banks to supply foreign currencies, buying dollars in their place. These arrangements were not designed for currency management purposes, but for providing liquidity in cases such as the Credit Suisse bailout. Accordingly, the swap agreements between the six major central banks (Fed, ECB, BoJ, SNB, BoE, and Bank of Canada) are far too small to stabilise the dollar given the likely scale of a run on it.

Current swap facilities compared with the scale of the problem are the equivalent of a mouse to an elephant. Increasing them can only take the comparison from a mouse to a rat relative to an elephant. Therefore, the only way a run on the dollar can be addressed is for the Fed to raise interest rates sufficiently to protect it. This is unlikely to be an initial response, but introduced after it is feared that a falling exchange rate adds to producer price and CPI inflation, and that a reluctance by the Fed to increase interest rates would risk undermining confidence in the dollar even further.

However, if the Fed increases dollar interest rates, it will weaken interest rate dependent asset values causing further securities liquidation by foreign holders. But that is the only solution for stabilising the dollar, even raising them high enough to discourage selling of the dollars raised from selling investments. Put simply, the Fed will then have to choose between protecting securities markets from further value deterioration and protecting the currency.

Not only would protecting the currency go against the grain of everything the Fed has tried to achieve by maintaining confidence in US financial markets, but it also has a duty to fund the government’s deficit. Sharply higher interest rates are bound to cause an economic slump, reducing taxes, and adding to welfare costs. Funding requirements for the US Treasury will increase significantly at a time when foreign ownership of US Treasuries are being liquidated. Funding costs will also increase. Furthermore, the liquidation of foreign owned assets currently estimated at $24.5 trillion would be accelerated by any attempt to protect the dollar by raising interest rates. Additionally, the strains faced by the commercial banking network would almost certainly lead to a full-on banking crisis.

For the Fed, it truly becomes a Morton’s fork dilemma.

The Asian response

The extent to which foreign governments, typically members of the Shanghai Cooperation Organisation and the non-Asian BRICS+ membership anticipate these developments can only be guessed at. But at the St Petersburg International Economic Forum last June, President Putin explained the negatives for dollar ownership to the attendees from eighty-one foreign official delegations. Since then, declarations of intent and applications to join both SCO and BRICS+ have been made by many nations. But so far, there is little evidence of actual dollar selling by them.

That they appear to be sitting on the fence between the western alliance and the Asian axis is a significant change from recent times when they would not have dared to question America’s monetary and military standing in the world. The explanation can only be that this crowd’s vested interests have shifted. Not only is an alliance with China and Russia holding out the prospect of a more positive future, but its members are increasingly scared of going down with a dollar-based financial system which has outlived its usefulness. It is easy to imagine why trade prospects with the Asian hegemons are relatively attractive, but to escape from one currency system to another requires a degree of confidence in the latter.

The signals emanating from Russia and China are positive, but as yet not substantiated. Russia’s Sergey Glazyev, officially appointed to design a new trade settlement currency for the Eurasian Economic Union, was the moving light behind the beefing up of the Moscow Gold Exchange to replace the LBMA facilities withdrawn from Russian miners and refiners in the wake of last year’s sanctions against Russia. He subsequently described in some detail the benefits of a gold-based rouble relative to the dangers of a fiat dollar based monetary system in an article for Vedomosti, a Moscow based financial newspaper on 27 December last. The shift of emphasis from the proposed EAEU trade currency to adopting gold backing for the rouble was notable.

In China, the signals are still opaque. Saudi Arabia has led an increasing number of nations willing to take payment in yuan for energy exports. Observers have pointed out that if the Saudis use the exchanges in Hong Kong and Shanghai, they can exchange yuan for gold. If the Saudis and others use this facility, then it amounts to swapping payments in petrodollars for payments in gold.

The oil for gold trade is still speculation. But it appears that the major Chinese banks are now offering their citizens the facilities to run gold accounts funded by yuan. Could this deliberate act by state-controlled banks amount to preparations for the remonetisation of gold? Could this be the way forward — the way a yuan gold standard will operate?

There are advantages for both the rouble and the yuan in such a move. For the rouble, a credible link with gold would permit interest rates over time to decline from current levels of 7%—10% to about 3% for obvious economic benefits. The pressure on the yuan is considerably less, with bond yields of most maturities already at between 2%—3%. China could easily adopt a gold standard. Furthermore, her incredibly high savings rate allows Chinese banks to expand credit without driving up consumer prices. It could be argued that China has no current need to secure the yuan to the value of gold, but to ensure rock solid international confidence in it as a currency the move makes enormous sense. Furthermore, both countries have significant quantities of bullion not declared as official reserves.

Clearly, both Russia and China are moving very carefully. They appear to be putting in place a Plan B in case there is a collapse in the western alliance’s financial system, comprising their fiat currencies, commercial banks, and even central banks.

They have no illusions about the risks they face from America’s weaponization of the dollar, and the fact that it leans on its five-eyes security partners to do her will. But it is the western position on gold which is also important. Against all international law, the Bank of England refused to return Venezuela’s gold on its government’s request, plainly on instructions from the Americans. The New York Fed refused to return some of Germany’s gold when requested — eventually conceding to the request.

We do know from research conducted long ago that the western alliance’s gold reserves are badly compromised through leases and swaps, leading to at least double ownership of much of it. With Russia and China now moving towards the reintroduction of gold backing for their currencies, there is an impending disaster for the western alliance’s decades of monetary deceit. Clearly, for the Asian hegemons to suddenly announce a return to a formal gold exchange standard for their currencies would irrevocably undermine the vanishing credibility in the dollar and its western stablemates. It would amount to a declaration of financial war of ultimate destruction.

Besides the risk that a financial war would lead to military conflict, it is not in the Asian axis’s strategic interests to be seen to be the guilty party. China still exports large quantities of goods to America and Europe. While her interests are moving more towards trading and investing in Asia, it is nonsensical to deliberately destroy her existing export markets. But the one thing over which China has no control is the actions of America. Both Russia and China have adopted a strategy of passively allowing the Americans to make all the strategic errors, which they have been doing in abundance. Iraq, Syria, Afghanistan, Georgia, Ukraine, then sanctions against Russia — the best the American can claim is occasionally something pyrrhic.

The time for Russia and China to declare their new currency arrangements are when such a move would be obviously a protective response to a deepening crisis for the dollar and its companion currencies. Only then would accusations that returning to gold exchange standards as an aggressive act against the west be demonstrably false. But it would be the final curtain on the error of western governments and their central banks buying into Keynes’s cool-aid, ditching gold standards as a barbarous relic, winding down their gold reserves in some cases to zero, and grasping the opportunity to intervene in all things economic in defiance of Say’s law.

Tyler Durden

Sun, 05/14/2023 – 15:30