“Ceiling The Deal?” – What Happens If Risk-Free Rates Turn Out To Be Full Of Risk

By Benjamin Picton of Rabobank

House Speaker Kevin McCarthy will this week meet with President Biden to attempt to nut out a deal on raising the US debt ceiling. The meeting is slated to occur tomorrow, and is looking more and more like last chance saloon for US politicians to find enough common ground to avoid a default that Janet Yellen and Jamie Dimon have both said would be a “catastrophe”. The WSJ this morning reports that the Biden administration is exploring “experimental” ways for the US to keep paying its bills until the ceiling is raised. Ever helpful, Donald Trump last week suggested that House Republicans should allow a default to occur should the Democrats refuse to support deep cuts to welfare spending. Trump is the clear poll leader for the GOP nomination for the Presidency, and his grip on the party will serve to paint nervous GOP lawmakers into a corner on spending concessions. The political cost of a climbdown is increasing, and the delta of a default occurring is increasing along with it.

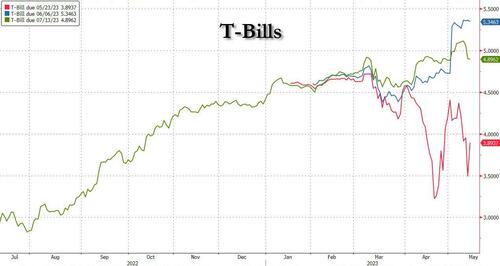

1-month T-bills are this morning paying 5.37% vs 4.89% for the 2-month note.

There’s a comical element in the market attempting to reflect increased credit risk for short-dated US government securities in traded yields. Once upon a time this situation would have been ludicrous, but we live in interesting times. The scenario that we are now countenancing is deeply binary. The yield premium in short-dated bills looks a bit like picking up pennies in front of a steamroller in the context of a potential default that would reverberate through a world financial system predicated on US government IOUs constituting a ‘risk free’ investment. With commercial real estate and US regional banks already teetering from rapid monetary tightening, how much more debt brinkmanship can the nerves of traders handle? What price assets if risk free rates turn out to be full of risk?

Speaking of monetary tightening, last week brought some interesting developments on inflation expectations. The University of Michigan 5-10 year inflation expectations spooked the market by printing at 3.2%. That was up two ticks from the April reading, and defied expectations of a 1 tick fall. As this Daily noted on Friday, the Bank of England raised their 2024 inflation forecast from 1% to 3.4%. With revisions that large, one would be forgiven for asking exactly what the point of forecasting is? On the flipside, New Zealand 2-year inflation expectations fell from 3.3% to 2.79% and the RBA revised down its forecast for 2023 trimmed-mean inflation from 4.3% to 4% the week before. That change in forecasts from the RBA sits oddly with an internal research document from September that the RBA released last week under a freedom of information request. This research showed that the RBA staff estimated 3.8% to be a “reasonable nominal neutral rate estimate”. If the boffins’ “reasonable estimate” of neutral is correct, that might explain why services inflation has been so persistent with a cash rate that has only just hit 3.85%.

Clearly the revelations out of the RBA imply that markets are under-clubbing the risk of higher policy rates. The idea that risk is weighted to the upside is also prevalent elsewhere, despite fracturing banking systems, weak forward indicators and signs that inflation has already peaked in most major economies. The Bank of England’s Huw Pill (always good for a line) has helpfully noted that UK inflation is at a “turning point”. Unfortunately, with UK growth in the doldrums, and GDP languishing below pre-Covid levels, that turning point resembles the one used by the Titanic moments before striking the iceberg. Pill had earlier told Britons to get used to the idea of being poorer, and our own UK expert, Stefan Koopman, believes that a recession is required to sustainably take the wind out of UK inflation pressures. Gloomy stuff.

Elsewhere, the Fed is poised to pause, and the ECB is sending signals that the end of the cycle is nigh. ECB Vice President Luis de Guindos last week said that there could still be more rate hikes on the way, but hedged his comments with the usual line that further hikes will depend on the flow of data and considerations of the tightening in credit conditions that was presaged by the Euro area lending survey earlier in the month.

Conjecture over whether or not central banks are doing enough to get inflation under control (or whether they can actually do anything to get inflation under control) is all well and good, but the debt ceiling remains the elephant in the room for now. Markets are fixing their eyes not on what is seen, but on what is unseen (the ‘star variables’), and hoping that the unthinkable doesn’t happen in the meantime. This week we will be looking forward to US politicians ‘ceiling a deal’ to keep markets turning over so we can all go back to worrying about normal things like inflation and geopolitics.

Tyler Durden

Mon, 05/15/2023 – 10:25