Beginning Of Liquidation Wave? Tiger Global Prepares To Dump A Segment Of Its Startup Portfolio

After a tumultuous 2022, Tiger Global Management has decided to dump hundreds of millions of dollars worth of private startups into the secondary markets, according to the Financial Times, citing people familiar with the upcoming move.

Chase Coleman’s $51 billion hedge fund has hired an adviser to explore options to sell some of its privately held companies in the secondary markets. The people said this was the best way for Coleman to return a portion of the money to shareholders.

“Talks are at an early stage, and potential buyers have said that any deal would probably be complicated by difficulties valuing Tiger’s private holdings, which include stakes in companies such as payments business Stripe, US software group Databricks, and China’s ByteDance,” the people said.

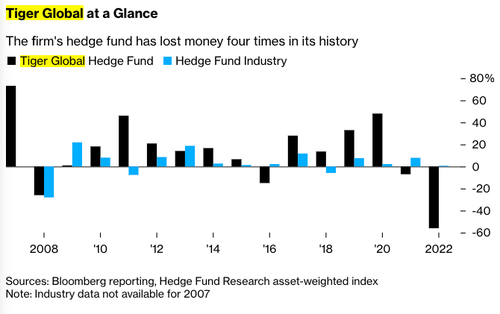

This comes as New York-based Tiger tumbled 56%, and the long-only fund plunged 67% in 2022, cementing its worst annual performance ever. FT’s source doesn’t specify if the selling is due to Tiger facing increasing redemptions, though it’s apparent liquidity is needed.

For Tiger and many of its peers, buying startups and then dumping them on public markets was an easy business model when the Federal Reserve pinned interest rates at the zero lower bound for a near a decade. However, with slumping mergers and acquisitions activity and a deep freeze in IPOs and SPACs, fewer companies are going public, indicating that Tiger is holding a bag of startups that it bought at lofty valuations.

As long as the Fed’s crusade to fight inflation remains in play, turmoil in capital markets will persist, which spells bad news for Tiger’s ability to offload startups at high valuations.

Financial Times pointed out a majority of Tiger’s assets are tied up in private companies. And this higher interest rate environment depresses valuations and makes it harder for cash-burning startups to raise additional money.

And so the great liquidation might have just kicked off as Tiger allegedly needs cash. Its exposure to illiquid venture capital bets that were made at high valuations has been its downfall. The music might have just stopped.

Tyler Durden

Mon, 05/15/2023 – 12:05