Soaring Rates Lead To Slowest Growth In Household Debt In Two Years As Mortgage Originations Plummet

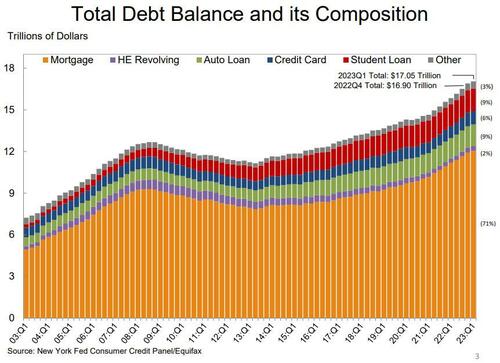

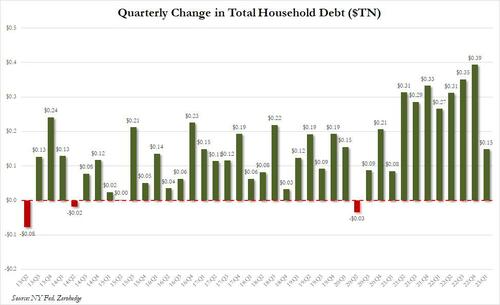

Total household debt rose by $148 billion, or 0.9%, to $17.05 trillion in the first quarter of 2023, according to the latest Quarterly Report on Household Debt and Credit.

This was the weakest quarterly debt increase in two years…

… hardly a good look for an economy that is entirely credit-driven, and may explain why the Citi US eco surprise index just dipped negative after a 4 month stretch in the green.

A detailed look at current debt balances by component:

- Mortgage balances shown on consumer credit reports increased by $121 billion during the first quarter of 2023 and stood at $12.04 trillion at the end of March, a modest increase.

- Balances on home equity lines of credit (HELOC) increased by $3 billion, the fourth consecutive quarterly increase following a nearly 13 year declining trend; the outstanding HELOC balance stands at $339 billion.

- Credit card balances were flat in the first quarter, at $986 billion, bucking the typical trend of balance declines in first quarters.

- Auto loan balances increased by $10 billion in the first quarter, continuing the upward trajectory that has been in place since 2011.

- Other balances, which include retail cards and other consumer loans, increased by $5 billion.

- Student loan balances now stand at $1.604 trillion, up by $9 billion from the previous quarter. In total, non-housing balances grew by $24 billion

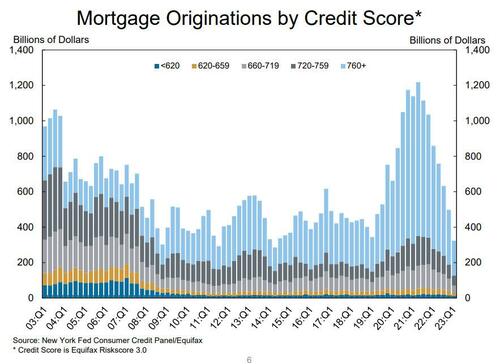

While total debt hit another record high, the impact of soaring interest rates was felt with originations sharply lower across the board:

- Mortgage originations, which include refinances, dropped sharply in the first quarter of 2023 to $324 billion, the lowest level seen since 2014, a quarter that was unusually low due to the “taper tantrum”

- The median credit score for newly originated mortgages decreased slightly to 765.

- What is remarkable is the collapse in mortgage originations in the highest FICO score bucket, which drove the housing market since 2020, and which has now cratered.

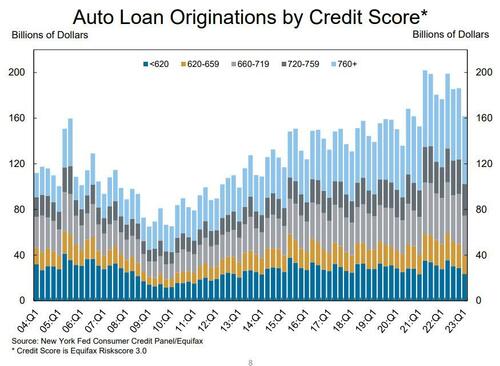

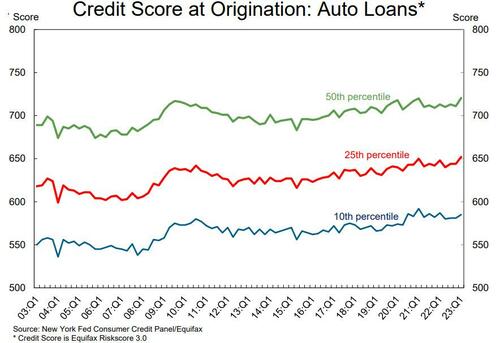

- The volume of newly originated auto loans was $162 billion, a reduction from pandemic-era highs but still elevated compared to pre-Covid volumes.

- The median credit score on newly originated auto loans ticked up 10 points, to 721, suggesting some tightening.

- Aggregate limits on credit card accounts increased by $119 billion, representing a 2.7% increase from Q4 2022 levels.

- Limits on home equity lines of credit were up by $9 billion in the first quarter.

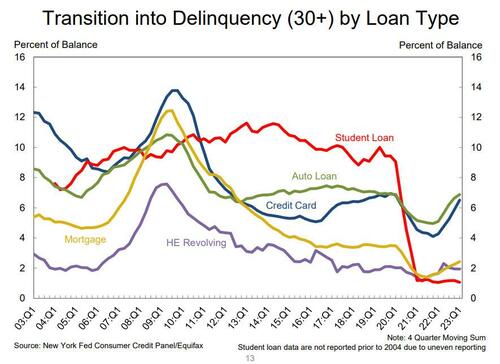

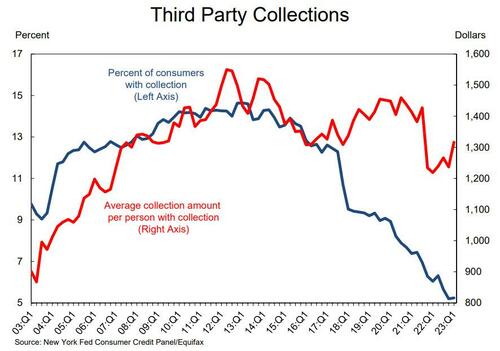

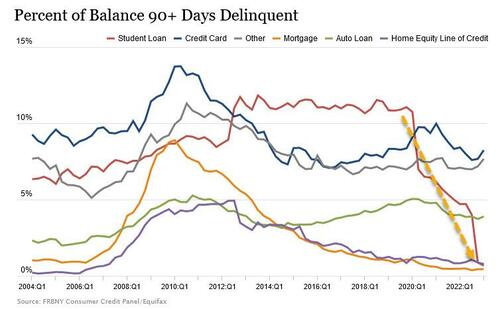

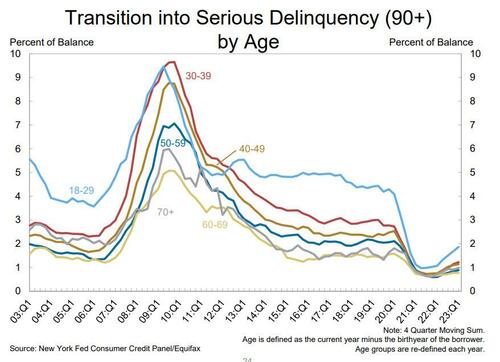

Also not surprising is that in a time of near record high rates, the share of current debt becoming delinquent increased for most debt types. The delinquency transition rate for credit cards and auto loans increased by 0.6 and 0.2%, respectively approaching or surpassing their pre-pandemic levels.

With countless debt-easing measures having been implemented in recent years (mostly post-covid) soon coming to an end, the mean-reversion here will be brutal.

The New York Fed also issued an accompanying Liberty Street Economics blog post taking a closer look at housing equity and mortgage refinancing as tools for funding consumer spending. Fourteen million mortgages were refinanced during the pandemic refinancing boom, during which $430 billion of home equity was extracted through cash-out refinances. About 64% of these mortgages were “rate refinances”, resulting in an average payment reduction of $220 monthly for those borrowers.

“The mortgage refinancing boom is over, but its impact will be seen for decades to come,” said Andrew Haughwout, Director of Household and Public Policy Research at the New York Fed. “As a result of significant equity drawdowns, mortgage borrowers reduced their annual payments by tens of billions of dollars, providing additional funding for spending or paydowns in other debt categories.”

The Quarterly Report includes a summary of key takeaways and their supporting data points. Overarching trends from the Report’s summary include:

Housing Debt

- There was $324 billion in newly originated mortgage debt in 2023Q1. With the pandemic-era refinance boom over and a slowdown in home sales, reported refinance and purchase mortgage originations both declined substantially in the first quarter.

- Although the foreclosure moratoria have been lifted nationally, new foreclosures have stayed very low since the CARES Act moratorium was put into place. About 35,000 individuals had new foreclosure notations on their credit reports, roughly flat with the fourth quarter.

Student Loans

- Outstanding student loan debt stood at $1.604 trillion in 2023 Q1.

- Less than 1% of aggregate student debt was 90+ days delinquent or in default in 2023 Q1, a small decline from the previous quarter. Delinquency rates fell substantially in the previous quarter due to the implementation of the Fresh Start program, which made previously defaulted loan balances current.

Unfortunately, the party is almost over as student loan payments are set to restart (by August 30th at the latest), around the time the Supreme Court will rule that Biden’s $20K forgiveness plan is unconstitutional. In short, the student loan delinquencies are about to come back with a historic vengeance.

Putting it all together: boomers who used the covid crisis to refi their homes into a record low mortgage rate and paid down their debt are sitting pretty; meanwhile millennials and Gen Zers who are stuck renting and whose student loans are about to kick in again…

… are facing a world of pain, especially those who are already not current on their auto loans.

More in the full presentation below.

Tyler Durden

Mon, 05/15/2023 – 12:45