“Could Be Days” – Yellen Reiterates Warning Of June 1st ‘X-Date’ For Debt-Ceiling

Treasury Secretary Janet Yellen has written to Congress, reiterating her warning that – in her completely apolitical position – the US government will run out of extraordinary measures to keep paying the bills by June 1st

As Bloomberg reports, the US Treasury Department said in a statement Friday that it had just $88 billion of extraordinary measures to help keep the government’s bills paid as of May 10.

That’s down from around $110 billion a week earlier and that means that just over a quarter of the $333 billion of authorized measures are still available to keep the US government from running out of borrowing room under the statutory debt limit.

Yellen’s accompanying letter is excerpted here (emphasis ours)

Dear Mr. Speaker:

I am writing to follow up on my previous letters regarding the debt limit and to provide additional information regarding the Treasury Department’s ability to continue to finance the operations of the federal government.

In my May I letter, I noted that our best estimate was that Treasury would be unable to continue to satisfy all of the government’s obligations by early June if Congress docs not raise or suspend the debt limit before that time. In that letter, I also noted that while it is impossible to predict with certainty the exact date when Treasury will be unable to pay all the government’s bills.

I would continue to update Congress as more information becomes available.

With additional information now available, I am writing to note that we still estimate that Treasury will likely no longer be able to satisfy all of the government’s obligations if Congress has not acted to raise or suspend the debt limit by early June, and potentially as early as June 1.

These estimates are based on currently available data, and federal receipts, outlays, and debt could vary from these estimates.

The actual date Treasury exhausts extraordinary measures could be a number of days or weeks later than these estimates.

I will provide an additional update to Congress next week as more information becomes available.

We have learned from past debt limit impasses that waiting until the last minute to suspend or increase the debt limit can cause serious harm to business and consumer confidence, raise short-term borrowing costs for taxpayers, and negatively impact the credit rating of the United States.

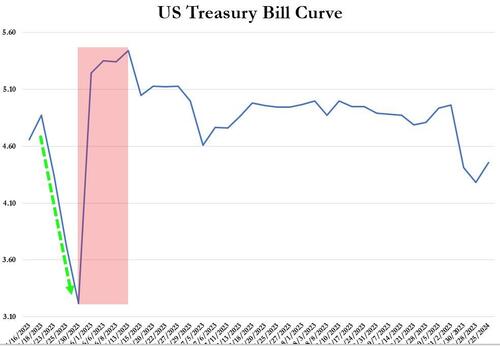

In fact, we have already seen Treasury’s borrowing costs increase substantially for securities maturing in early June. If Congress fails to increase the debt limit, it would cause severe hardship to American families, harm our global leadership position, and raise questions about our ability to defend our national security interests.

The T-Bill curve ‘kinked’ even more on the new letter…

Her warning fits with Piper Sandler’s Don Schneider’s calculations that have seen the window collapse recently…

X-date outlook is worsening as FDIC withdrew $12bn on May 4-5 from TGA & Treasury released new estimates of extraordinary measures remaining. Looking like $20bn cash on hand at end of day on June 1 (old expectation was $38bn) https://t.co/Zf6dIaBIkQ pic.twitter.com/cbF3LVdiwW

— Donald Schneider (@DonFSchneider) May 15, 2023

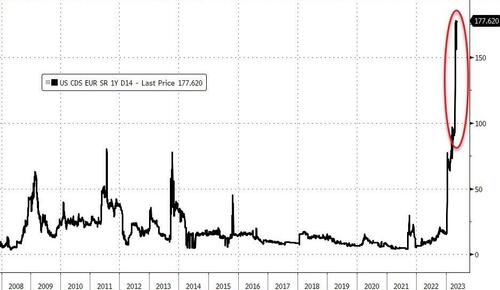

Which likely explains why USA Sovereign risk is continuing to push new record highs…

Read the full letter below:

Tyler Durden

Mon, 05/15/2023 – 16:36