Much Of The Markets Still Don’t Believe The US Can Default

By Ven Ram, Bloomberg markets live reporter and strategist

“if political [debt ceiling] kabuki ends in risk-off drama then Fed does QE (like BoE last Oct)…this is why other assets classes not worried.” – BofA’s Michael Hartnett

Except in some specific corners, most of the markets don’t quite buy the story that the US Treasury could, after all, default on its obligations.

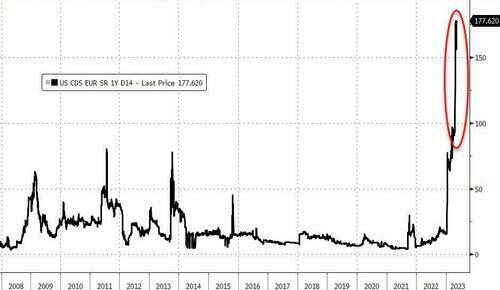

T-bills due around the estimated time of the X-date have shown some angst, with yields on one-month instruments up some 200 basis points in less than a month. Meanwhile, credit-default swaps are pricing in a 3% chance of a default. While that may not seem alarming, that default pricing is way higher than in 2011 and 2013, when we were last witness to such stress.

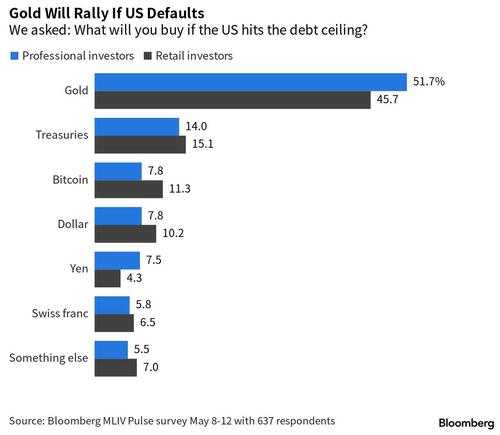

Yet, the rest of the markets are still pretty sanguine about the eventual outcome. The S&P 500 is still holding onto to its 7+% rally for the year, while the Nasdaq 100 is up a gravity-defying 22%. Front-end Treasury yields have come off more than 100 basis points from their peak for the cycle, but that is more a reflection of the markets positioning — rightly or wrongly — for a putative Fed pivot rather than anything to do with the debt-ceiling impasse. Gold, which BBG readers reckon will be a haven should the US indeed default, hasn’t done much so far this month.

While the supposed X-date — when the Treasury will have run through its gamut of emergency maneuvers — is supposedly June 1, in reality it may turn out to be different because it’s impossible to look through the crystal ball and know precisely when, say, tax receipts may flow in. That is perhaps one reason the markets reckon that lawmakers will do what common sense dictates by the time the D-Day rolls in.

X-date outlook is worsening as FDIC withdrew $12bn on May 4-5 from TGA & Treasury released new estimates of extraordinary measures remaining. Looking like $20bn cash on hand at end of day on June 1 (old expectation was $38bn) https://t.co/Zf6dIaBIkQ pic.twitter.com/cbF3LVdiwW

— Donald Schneider (@DonFSchneider) May 15, 2023

The point, though, is the the US economy, already facing considerable headwinds from the turmoil in the banking industry, isn’t quite so well-placed to flirt with another Wile E. Coyote moment. And that is the part the stock markets haven’t quite priced in — yet.

Tyler Durden

Tue, 05/16/2023 – 06:55