Buy In May, Don’t Stay Away As Fed Eases Off Brake

By Simon White, Bloomberg markets live reporter and strategist

The end of the Federal Reserve’s hiking cycle promises to re-assert US equities’ global outperformance.

Few have heard of St Leger Day. A horse race held in late summer in Doncaster in the UK, it is the less-repeated second part of the well-known stock-market aphorism about selling in May, and not coming back until the race’s date in mid-September.

But this year, aptly, investors should hold their horses before following the maxim’s advice. With the Fed looking like it is done hiking rates, the outlook for US equities is positive, especially versus other developed markets.

The Fed of course may not be done, but it is looking increasingly likely it is. The real policy rate is now positive, with nominal rates higher than inflation; banking stress continues to hoover velocity from the system, tightening credit; and there are increasing signs the jobs market is weakening. The Fed’s risk-reward is starting to favor a cessation of the rate-hiking cycle after 500 bps of increases in a little over a year.

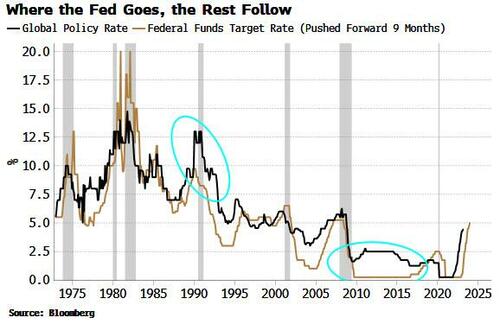

Where the Fed goes other central banks tend to follow, but with a lag. Central banks’ independence from their government masters is a bit of myth, one that will not fully survive the highest inflation seen in five decades. But DM central banks’ independence from the Fed has never really been the case.

The chart below shows the Fed rate leads the median policy rate of DM central banks by about nine months. The ups and downs of Fed rate policy strongly predict the interest-rate path of other central banks.

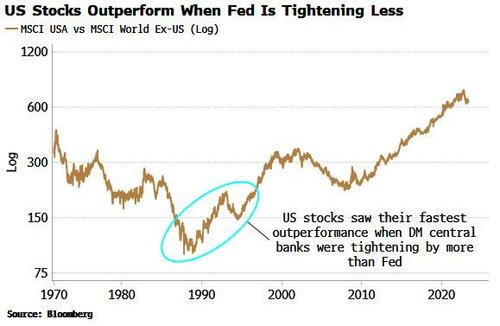

The most notable divergences were in the early 1990s and the 2010s, when DM policy rates were higher than the Fed’s, or they were rising when the Fed rate was not. Both of these periods coincided with US equities outperforming their DM counterparts. In the early 90s, this was the steepest outperformance seen over at least the last 50 years.

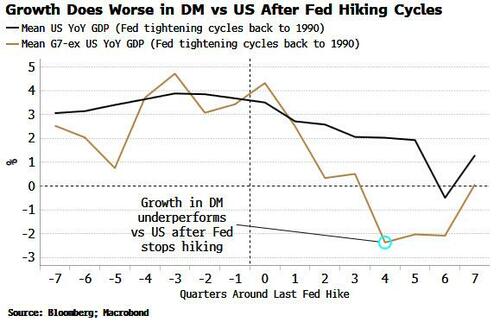

Growth is a lagging indicator, and it tends to fall just before central banks stop hiking, and continue falling afterward. But as DM central banks are behind the Fed, they continue to tighten, leaving DM GDP to underperform US GDP in the quarters after the Fed’s last hike.

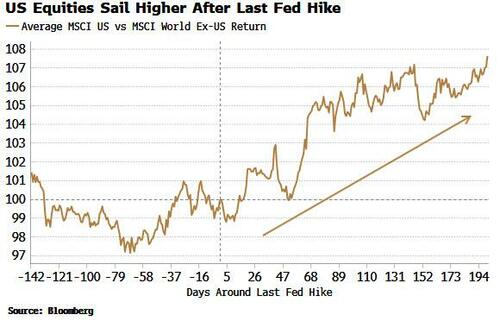

Stock markets are forward looking, and anticipate this divergence in growth. The ratio of US stocks versus developed-market ex-US stocks typically bottoms very soon after the last Fed hike, and US stocks go on to comprehensively outpace their DM cousins over the next year.

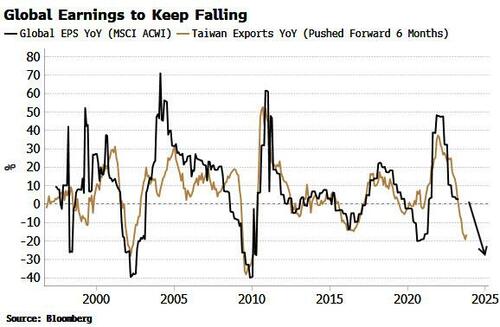

Non-US equities are also likely to face increasing headwinds from slowing earnings. Small, open, export-orientated countries like Taiwan are highly sensitive to global conditions, which is why Taiwanese exports are an excellent leading indicator for global EPS. As the chart below shows, the fall in Taiwan’s exports points to further weakness in global EPS growth.

Ultimately increased rivalry and less cooperation between China and the US will be sub-optimal for global growth due to higher costs associated with re-shoring; less global trade (e.g. semiconductor-related exports from the US to China); and a general decline in the velocity of ideas, knowledge and know-how. But in the short term, DM ex-US countries are poised to fare worse than the US, especially as the former are more sensitive to China’s growth.

Also in US stocks’ favor is seasonals, with May to November having a strong and persistent bias over the last 50 years for US stock-market outperformance.

The debt ceiling may cause some near-term volatility, but even in a low-probability worst-case-scenario where a deal is not reached – which would probably not lead to a full default, but instead impinge on growth as the Treasury curtails its net spending – the Fed would be highly likely to cut rates significantly. US stocks may falter, but the extreme monetary stimulus would likely not be enough to derail their DM outperformance.

Furthermore, stubborn inflation may encourage DM central banks to try to keep rates higher for longer. The inflation rate has risen over the last year in the UK, Italy, Japan, France and Germany, while in the US it has fallen by over three percentage points.

The UK and Europe have one to two more rate hikes priced in, while Canada, Australia, New Zealand and Sweden are all anticipated to do at most one more 25 bps hike. Keeping rates high will further hinder growth, while conditions in the US ease as the expectations of rate cuts persist, with the growing likelihood they are soon delivered.

So forget St Leger Day, the horse you want to back now is the US stock market.

Tyler Durden

Tue, 05/16/2023 – 10:05