Solid 20Y Auction: First Stops Through Since Jan As Foreign Demand Jumps

In a day when yields are spiking higher, and tracking the latest short squeeze in stocks, today’s just concluded $15 billion auction of 20Y paper came in surprisingly strong.

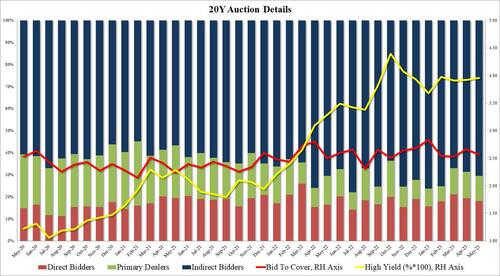

Pricing at a high yield of 3.954%, the auction took advantage of today’s selling to stop through the When Issued 3.964% by 1 basis point, the first stop through since January.

The bid to cover of 2.56 was on the low side, printing below last month’s 2.66 and below the recent average of 2.65.

The internals, on the other hand, were stronger with Indirects taking down 70.6%, above last month’s 68.7% and the highest since 75.3% in February. And with Directs taking down 18.1%, meant Dealers were left holding 11.3%.

Overall, this was a solid, if hardly spectacular auction, and hardly a testament to any debt ceiling freakout.

Tyler Durden

Wed, 05/17/2023 – 13:29