Now’s The Time To Get Ahead Of Inflation Resurgence

Authored by Simon White, Bloomberg macro strategist,

The current lull in inflation offers the perfect opportunity to take advantage of cheap inflation hedges before price growth starts to accelerate again.

Narratives change fast in finance. From inflation that was expected to be stubborn and persistent, there’s a view quickly gaining in popularity that, like Keyser Soze in The Usual Suspects, inflation is about to vanish into thin air.

That’s unlikely, as I’ll show. But the market has already been trading off this theme for several months, with many inflation trades now underwater. This opens up an ideal opportunity to hedge portfolios ahead of the re-acceleration of prices we’re likely to see as early as the end of this year.

Specifically, the current window is the time to rotate back toward low-duration stocks and sectors such as energy, and away from tech; reduce positioning in fixed-income securities such as Treasuries and corporate bonds; and increase exposure to inflation-linked debt, commodities and other real assets.

Up until October markets were trading rising inflation. Yields rose above 4.3%, their highest in almost fifteen years; commodities had rallied over 90% from their pandemic lows; and investors were shunning high-duration growth sectors like tech in favor of low-duration staples and utilities.

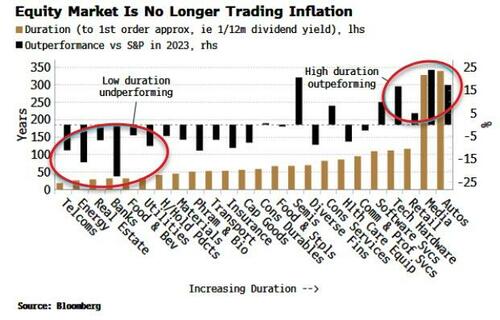

Inflation in the US peaked last summer, and since then the market has been happy to front-run the inflation Pandora’s Box soon closing again. But this year we have seen a stark reversal in the performance of different equity sectors, with tech, autos and media now coming out on top, while hitherto winners such as telecoms, energy and staples have been lagging.

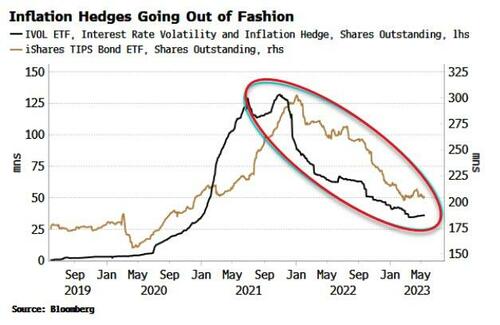

The TIP ETF is an ETF of US inflation-linked securities, while IVOL is an ETF designed to hedge inflation risk. Both saw a marked rise in their shares outstanding through 2021, but have since given back most of this increase.

Commodities have been underperforming, leading to sizable outflows from commodity ETFs, while the BofA Global Fund Manager Survey (GFMS) has the net percentage of fund managers overweight commodities down to flat, its lowest level since 2020. Also, in May, the GFMS showed the largest positioning change into tech, while commodities and utilities saw the biggest position falls.

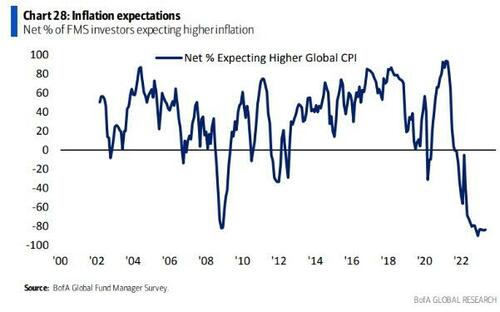

Furthermore, the survey shows the net percentage of fund managers expecting higher inflation slumping to 20-year lows, and continuing to decline even after CPI peaked, suggesting managers are increasingly confident price growth will keep falling. This is not a market fearful of inflation.

Source: Bank of America

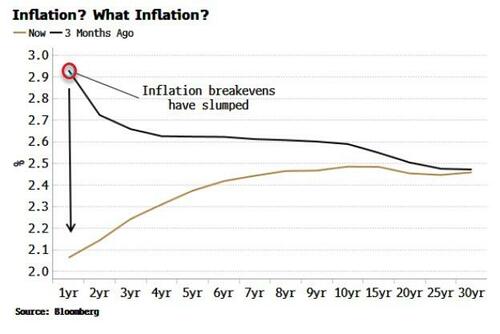

We can explicitly see the market’s insousiance on price growth by looking at CPI fixing swaps. These expect the current disinflationary trend to continue for at least the next year, with headline CPI expected to fall to 2.4% by March. Meanwhile the inflation breakeven curve has gone from being completely inverted three months ago, to being almost entirely positively sloping, as near-term expectations of inflation have collapsed.

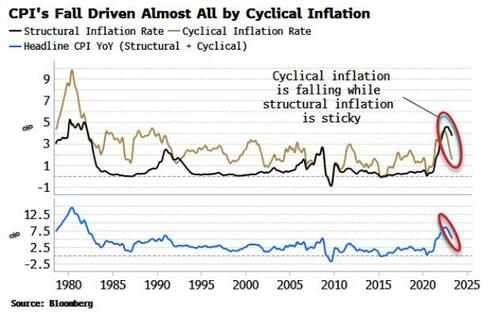

But the current disinflationary trend will not last much longer, and inflation is set to begin re-accelerating again in the coming quarters. To see this, we can break CPI up into a structural and a cyclical component. The structural component is the sub-indices of the headline CPI index that are above their long-term trend, and persistently so. The cyclical component is what is left over. The components are defined such that structural + cyclical is equal to headline CPI.

The chart below shows that almost all of the decline in headline inflation has been driven by the fall in the cyclical component, while the structural component is still near its highs. But soon cyclical inflation will, due to its cyclicality, begin rising again, reinforcing still-elevated structural inflation. Headline inflation is thus likely to make a higher low, and begin rising again.

This is what we saw in the 1970s. Inflation made a high in the 1974 recession, then began to fall, but it based at a level higher than the previous low. It then went on to make a new high. The economist J. Bradford De Long, in his brilliant essay America’s Peacetime Inflation: The 1970s, offered a convincing explanation why:

“Before the supply shocks hit, wage inflation was slowly trending upward. After the supply shocks had passed, price inflation quickly returned to levels consistent with wage and productivity growth, and wage inflation was slowly trending upward”

Today productivity growth is falling, and while wage growth may have slowed slightly in recent months, it is still considerably higher than it was three years ago.

The stage is thus set for a renewal in inflation’s upward trend. This will shake confidence that inflation is a “one-shot” problem and instead is likely to be with us for some time. This is likely to prompt a root-and-branch rethink about how to invest in an environment of persistent and entrenched inflation

Inflation hedges that look cheap today thus won’t be cheap for very long

Tyler Durden

Thu, 05/18/2023 – 08:25