Bumper Week For Banks & Big-Tech But Bonds Suffer Biggest Bloodbath In A Year

“The things we were most worried about didn’t get worse..” was the phrase overheard on one business media channel to sum up why the markets rallied this week…

A week of debt-ceiling optimism-fueled short-squeezing ran into a wall of OpEx flows, Powell’s (hawkish) comments, Yellen’s banking crisis still ongoing reports, and finally reports that debt ceiling talks are going nowhere.

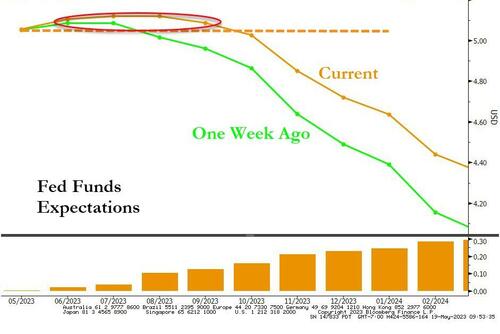

Fed Chair Powell painted a hawkish picture of inflation-fighting warrior during this morning’s panel discussion, highlighting that “failure to get inflation down would prolong pain,” and that “inflation is still far above our 2% objective.” Powell signaled a pause, stating that “we can afford to look at data”, but he noted that the “market rate-path reflects a different forecast than The Fed.”

Powell further extended the “coordinated” Fed messaging from FOMC speakers seen over the the past week – which Nomura’s Charlie McElligott points out has clearly been the FOMC looking to alter the market’s assumed probabililty distribution of the Fed path continuum which is creating the false optic of ‘immiment Fed cuts’ within implied pricing…

Source: Bloomberg

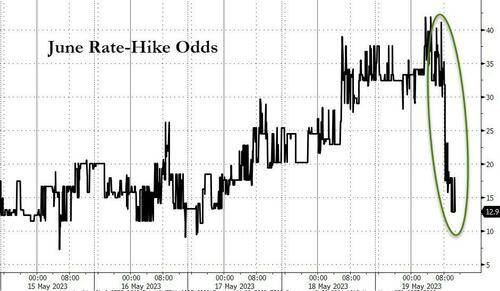

However, comments (below) from Yellen (banking crisis) and Washington (debt ceiling – no deal), sent June rate-hike odds plunging…

Source: Bloomberg

Comments from Treasury Secretary Yellen were interesting given the big gains in regional banks this week as CNN reported her telling the big bank CEOs that “more mergers may be necessary”…

Which roughly translated means: more bank failures are imminent – which is ironic given that regional bank stocks soared almost 10% this week – the best week since Nov 2020 – but Yellen’s comments spooked them today…

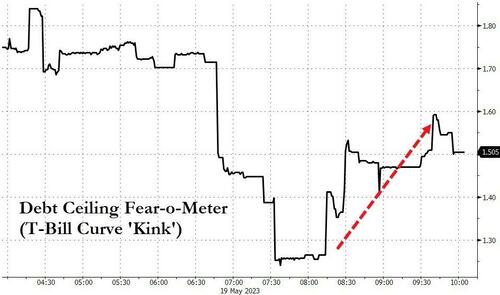

Then Washington peed in the punchbowl as House Speaker Kevin McCarthy’s top debt-ceiling negotiators reportedly “abruptly left a closed-door meeting with White House representatives soon after it began Friday morning, throwing the status of talks to avoid a US default into doubt.” Thus crushing optimism over the debt-ceiling talks.

Source: Bloomberg

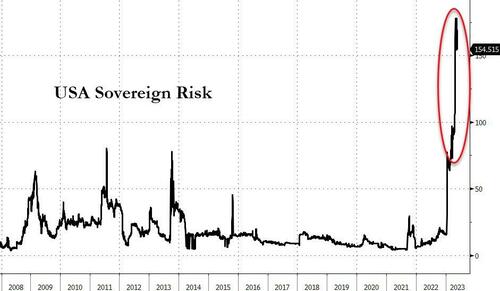

Bear in mind that the ‘longer-term’ sovereign risk of the USA remains at extreme highs…

Source: Bloomberg

However, on the week, MegaCap-Tech continued to attract momo/safe-have/FOMO/AI flows with Nasdaq soaring (The Dow was the laggard but still green on the week)…

Shorts were squeezed on the week, but today’s OpEx chaos may spoiled the ability to ignite it again…

Source: Bloomberg

While a handful of MegaCap Tech names led the markets higher, retail stocks were clubbed like a baby seal after TGT, WMT, and FL (FootLocker) also signaled the consumer may be weakening significantly this week…

Source: Bloomberg

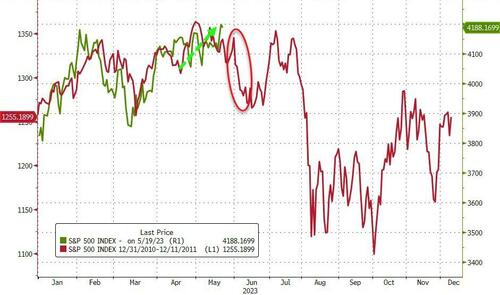

Just remember, we’ve seen this pattern of debt-ceiling optimism turn into pessimism before (in 2011)…

Source: Bloomberg

And Nasdaq is extremely overbought…

Source: Bloomberg

Yields exploded higher this week with the short-end massively underperforming. Note that the selling pressure was almost solely during the US day session…

Source: Bloomberg

That is the biggest weekly rise in 2Y yields since June 2022.

Source: Bloomberg

And a massive curve flattening (inverting further)…

Source: Bloomberg

The dollar rallied for the second week in a row but hit notable resistance and faded today…

Source: Bloomberg

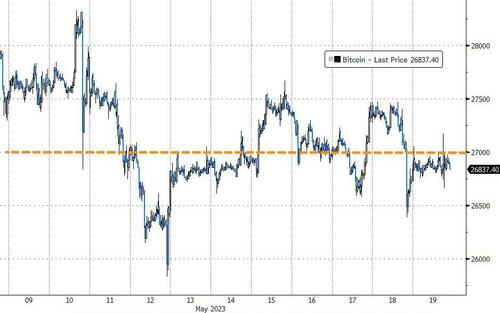

Bitcoin chopped around $27,000 (+/- $500) all week…

Source: Bloomberg

Gold’s worst week since Feb, but did bounce back today…

Copper was flat on the week but crude managed gains (despite weakness on the day)_

NatGas soared 15% this week, back at 2-month highs…

Finally, we give the last words of the market week to Nomura’s Charlie McElligott who has good news and bad news for what happens next: the recent PTJ talking point on this current environment looking like the 2006 / 07 playbook increasingly “feels” like the right one: the Equities market can continue to absolutely party until the end-game arrives… and it can take much longer than you think despite “things breaking along the way,” just ripping-out hearts in the meantime as we continue to fend off worry-after-worry, where pervasive skepticism and cynicism towards market conditions keep sentiment- and positioning- “light” and in-turn, continue to feed into a “buyers are higher” pain-trade melt-up within Risk-Assets in the meantime.

Options skews suggest a lot of ‘over-hedging’ remains…

However, McElligott warns, we’ve seen this pattern of behavior before: Similar to my January comments on the “most mis-priced risk” in markets being a false assumption on market sequencing which them assumed “pause then cut,” instead of the risk of the Fed needing to actually take Terminal projections higher, which is exactly what then happened throughout the month of February and roiled markets on account of the January “animal spirits” data phenomenon after the Fed’s premature easing of FCI… it feels like the market is “starting” to get the joke again that there is “growing delta” for yet-another false assumption, resizing the probability distribution of the the bi-modal humps (mega-crash rate-cut AND/OR high-for-longer).

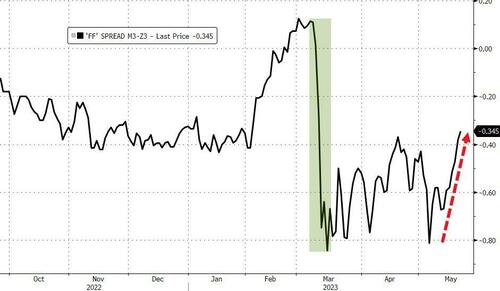

The June-Dec Fed-Funds spread is steepening to reflect this apparent shift…

Source: Bloomberg

The market could get stopped-OUT of the current “pause then cut” assumption and / or get stopped-INTO a disaster “pause then hike” flip…

Source: Bloomberg

…and remember, a seemingly / outwardly “bullish” debt-ceiling deal getting done actually perversely instead releases a new wave of tightening, particularly due to a massive TGA rebuild thereafter with ENORMOUS T-Bill issuance in the months thereafter, creating a monster liquidity drain.

So, be careful what you wish for and maintain light positioning (the latter harder than it sounds amid the AI-phoria).

Tyler Durden

Fri, 05/19/2023 – 16:00