Visualizing The Decline Of Affordable Housing In The US

Over 80% of U.S. residents have chosen to live in an urban setting, as of 2023.

And, as Visual Capitalist’s Chris Dickert and Pernia Jamshed detail below, with that number set to rise to nearly 90% by 2050, house prices are rising, with significant consequences to housing affordability.

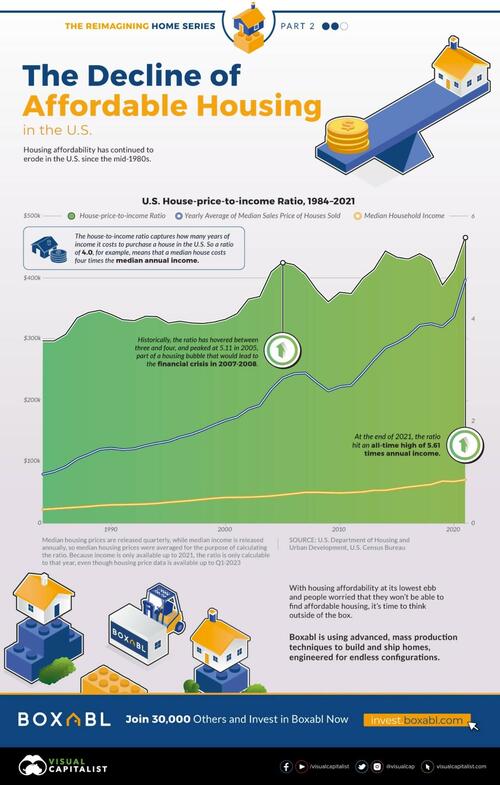

This visualization, the second in the Reimagining Home Series from our sponsor Boxabl, takes a deep dive into the evolution of the housing market in the U.S.

Housing Affordability At Its Lowest Ebb in Decades

The U.S. house-price-to-income ratio, which tracks house prices in multiples of annual income, has steadily climbed since the mid-1980s, when the market was recovering from a real estate crash earlier that decade.

Historically, the ratio has hovered between three and four. But in the early aughts, the ratio passed four and kept going, reaching a high of 5.11 in 2005. The ratio fell somewhat in the aftermath of the subprime mortgage meltdown, but never returned to historical averages. New records were set in 2014 (5.33), and again in 2021 (5.61).

Note that because median housing prices and median household incomes are released at different frequencies, quarterly versus annually respectively, in order to calculate the ratio, housing prices were averaged on an annual basis.

| Year | Median House Price | Median Household Income | Ratio |

|---|---|---|---|

| 1984 | $79,950 | $22,415 | 3.57 |

| 1985 | $84,275 | $23,618 | 3.57 |

| 1986 | $92,025 | $24,897 | 3.70 |

| 1987 | $104,700 | $26,061 | 4.02 |

| 1988 | $112,225 | $27,225 | 4.12 |

| 1989 | $120,425 | $28,906 | 4.17 |

| 1990 | $122,300 | $29,943 | 4.08 |

| 1991 | $119,975 | $30,126 | 3.98 |

| 1992 | $121,375 | $30,636 | 3.96 |

| 1993 | $126,500 | $31,241 | 4.05 |

| 1994 | $130,425 | $32,264 | 4.04 |

| 1995 | $133,475 | $34,076 | 3.92 |

| 1996 | $140,250 | $35,492 | 3.95 |

| 1997 | $145,000 | $37,005 | 3.92 |

| 1998 | $151,925 | $38,885 | 3.91 |

| 1999 | $160,125 | $40,696 | 3.93 |

| 2000 | $167,550 | $41,990 | 3.99 |

| 2001 | $173,100 | $42,228 | 4.10 |

| 2002 | $186,025 | $42,409 | 4.39 |

| 2003 | $192,125 | $43,318 | 4.44 |

| 2004 | $218,150 | $44,334 | 4.92 |

| 2005 | $236,550 | $46,326 | 5.11 |

| 2006 | $243,750 | $48,201 | 5.06 |

| 2007 | $244,950 | $50,233 | 4.88 |

| 2008 | $229,550 | $50,303 | 4.56 |

| 2009 | $215,650 | $49,777 | 4.33 |

| 2010 | $222,700 | $49,276 | 4.52 |

| 2011 | $224,900 | $50,054 | 4.49 |

| 2012 | $244,400 | $51,017 | 4.79 |

| 2013 | $266,225 | $53,585 | 4.97 |

| 2014 | $285,775 | $53,657 | 5.33 |

| 2015 | $294,150 | $56,516 | 5.20 |

| 2016 | $305,125 | $59,039 | 5.17 |

| 2017 | $322,425 | $61,136 | 5.27 |

| 2018 | $325,275 | $63,179 | 5.15 |

| 2019 | $320,250 | $68,703 | 4.66 |

| 2020 | $336,950 | $68,010 | 4.95 |

| 2021 | $396,800 | $70,784 | 5.61 |

Housing data is available up to the first quarter of 2023, when median prices eased off from a record-high $479,500 at the end of 2022 to $436,800 in the first quarter of this year.

Because median household income is currently only available up to 2021, it’s not possible to calculate the ratio past that. However, unless there was an unusually large increase in income, the ratio has likely remained near record highs.

And throughout the seemingly unstoppable rise in house prices over the 38 years covered above, income has failed to keep up. Between 1984 and 2021, median incomes rose 3.16x from $22,415 to $70,784, while median housing prices increased nearly 5.26x to $423,600, up from $78,200.

Issue Top of Mind For Local Communities

Amid the steady erosion of housing affordability, U.S. residents have reacted with rising concern. In 2018, when the Pew Research Center asked about major problems affecting local communities, the top spot went to Drug Addiction at 42%, compared to 39% on the Availability of Affordable Housing.

In 2021, the situation reversed itself and housing affordability was the #1 problem according to 49% of respondents, an increase of 10%. Drug Addiction, on the other hand, fell to 35%.

In general, younger Americans (55%), urban residents (63%), and those with lower incomes (57%) expressed more concern than their counterparts.

Is There a Doctor in the House?

So what’s causing the erosion of housing affordability in the U.S.?

Ultimately, the U.S. is not building enough houses to keep pace with population growth. And you can see this in the housing start data. In January 1959, there were around 1.7 million housing starts, compared to January 2023, when there were 1.3 million. And this decrease happened despite the fact that the U.S. population nearly doubled, from 176 to 335 million.

Lots of different forces are working together at the local level to stop more houses from being built. Space is one reason. Local zoning laws that limit the construction of multi-family homes is another culprit. The COVID-19 pandemic has also caused global supply chain issues, leading to rising material costs for housing.

And the icing on the cake? Rising interest rates are making it even harder for first-time homebuyers to enter the market.

Thinking Outside of the Box on Housing

With housing affordability at its lowest ebb in over a decade and people worried that they won’t be able to find a place to live, it’s time to think outside of the box.

Boxabl uses advanced, mass production techniques to build and ship homes that significantly lower the cost of home ownership for everyone.

This is the second piece in the Reimagining Home Series. Part 1 takes a deep dive on urbanization in the U.S., while the third and final piece looks at how modular homes could be a solution to the U.S. affordability crisis.

Tyler Durden

Fri, 05/19/2023 – 22:40