Turkish Lira Flash Crashes To Record Low On Goldman’s Dire Central Bank Outlook

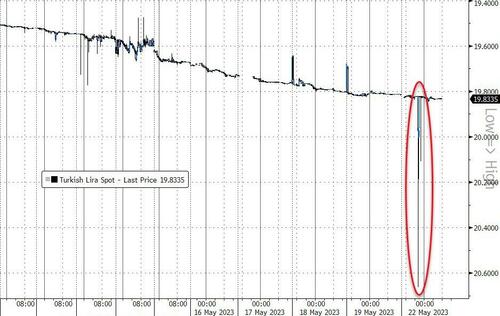

The Turkish Lira briefly tumbled as much as 4.1% to breach past the 20 per US dollar mark for the first time ever amid thin liquidity early Monday. At that point the central bank intervened, and the currency quickly pared losses and was last trading at 19.8339 per dollar, which excluding the brief flash-crash, is the lowest level on record for the distressed currency.

The ongoing plunge in the Lira comes days ahead of the presidential runoff round on Sunday, after President Recep Tayyip Erdogan failed to secure more than 50% of the ballots in the first round of voting on May 14, although the final outcome appears to be assured after earlier today Turkey’s Sinan Ogan endorsed Erodgan in the runoff round, effectively guaranteeing him a victory. That said, one- week implied volatility on USD/TRY pair jumps to 30% versus 17.2% on Friday.

And if it’s not the election outcome, what caused the sudden collapse in the lira? The reason, as we pointed out on Friday, was a dire note by Goldman FX strategist, Clemens Grafe, in which among other things, he found that the central bank’s “net foreign assets fell by US$3.2bn to negative US$14.8bn”, warned that “given the slowdown in the rise of TRY deposits and this week’s decline, we think TRY liquidity in the system is becoming more limited” and, most ominously, predicted that “pressure on the reserves has shifted from the current to the capital account despite the measures in place to limit capital outflows. “

Below we excerpt from the Goldman note which, if accurate, could lead to a rapid and dramatic reprising of the lira far lower from its current, manipulated, and artificially-lofty level:

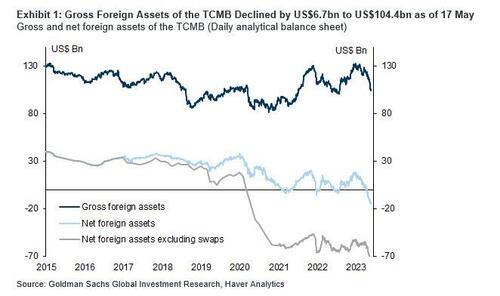

As of 17 May, the TCMB’s foreign assets declined sharply by US$6.7bn to US$104.4bn compared with a week ago, against a US$3.5bn fall in foreign liabilities to US$119.2bn (US$2.0bn fall in liabilities to nonresidents and US$1.5bn to banks). Hence, net foreign assets fell by US$3.2bn to negative US$14.8bn.

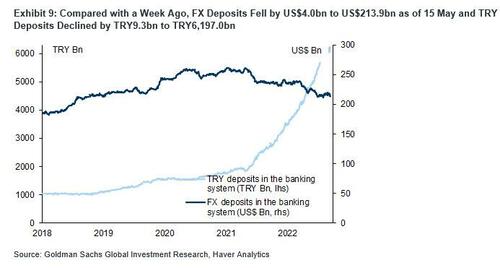

TCMB’s swaps with banks declined only slightly, by US$0.5bn compared with a week ago, to US$36.6bn as of 17 May, whereas FX deposits in the overall banking system fell much more, by US$4.0bn (as of 15 May) to US$213.9bn (TRY deposits also declined by TRY9.3bn to TRY6,197.0bn).

The decline in both TRY and FX deposits signals that funds are leaving the system amid heightened uncertainty before a presidential election runoff on Sunday, 28 May. Given this, we think stopping leakage from the system and keeping the Lira stable are the TCMB’s primary concern at the moment, also reflected in the currently high premiums placed on both FX and TRY cash in Turkey.

Using traditional measure for the TCMB’s usable reserves (subtracting gold, bilateral swaps with other central banks and SDR allocation from total reserves) points to only US$29.4bn FX liquidity at the TCMB. This number is, however, from last week given that the TCMB publishes its reserve composition with a week lag. And the decline in foreign assets this week means that it is currently even lower. However, we think that this way of measuring the TCMB’s FX assets has become somewhat outdated for two main reasons.

- First, the central bank’s recent interventions in the market to support the Lira via selling a significant portion of its gold reserves amid high household demand means that gold is becoming more of a liquid asset and arguably shouldn’t be fully subtracted.

- Second, swaps with other central banks have been used in bilateral trade between Turkey and the source countries. This means that their contribution to reserves has already declined since the swap lines were created and hence they should not be taken out in full (however, we do not know what percentage of them have been used for trade).

While these factors make the calculation of the TCMB’s FX liquidity much more complex, they also mean that the Bank’s liquid assets are likely higher than the implied US$29.4bn by our traditional measure.

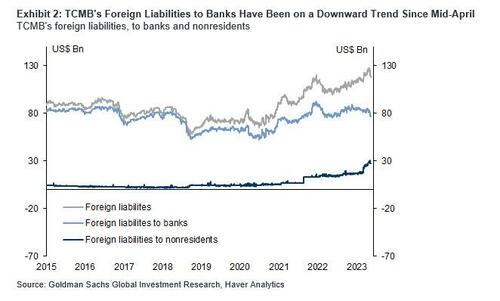

This week brings the total decline in the TCMB’s foreign assets in May to US$10bn, more than half of which was driven by a fall in the TCMB’s liabilities (US$5.8bn), to nonresidents (US$1.3bn) and to banks (US$4.4bn). We think some of the decline in the TCMB’s liabilities to banks is explained by a US$2.7bn fall in overall FX deposits in the system over the same period leading to a lower level of required FX reserves to be held at the central bank. The rest of the fall in banks’ deposits at the TCMB could reflect a shift into swaps, which rose by US$1.8bn despite the fall in FX deposits over the same period. However, the TCMB’s liabilities to the banking sector have been on a downward trend since mid-April falling by US$7.8bn, and this is only partially explained by developments in overall FX deposits in the system.

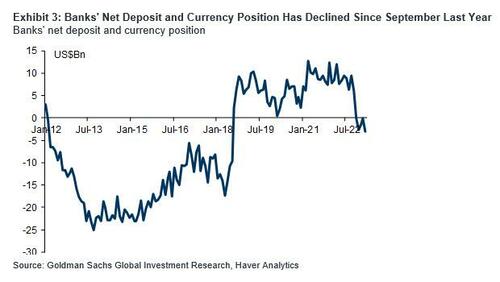

This, in our view, could be signalling that banks are under FX liquidity pressures after bringing in most of their FX assets from abroad and funding half of the current account deficit last year, and are now in need of withdrawing FX from the central bank. Turkish banks’ liquidity position has been declining since September last year and their net FX deposit position has turned negative since November. We think this is a signal that pressure on the reserves has shifted from the current to the capital account despite the measures in place to limit capital outflows.

Compared with a week ago, the TCMB increased its net traditional funding by TRY32.5bn to TRY487.2bn, as of 18 May. However, given the slowdown in the rise of TRY deposits and this week’s decline, we think TRY liquidity in the system is becoming more limited.

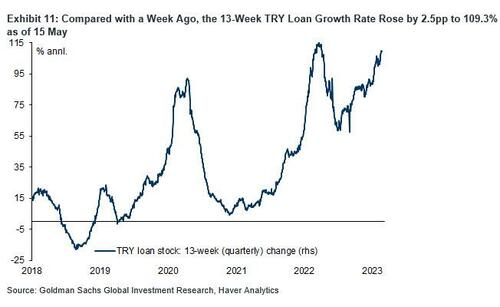

This is reflected in increasingly restricted access to credit for both households and most corporates. Despite limited liquidity in the system, however, the TRY 13-week loan growth rate continues to increase, this week by 2.5pp to 109.3% (annualized.) as of 15 May.

In our view, the discrepancy between limited liquidity and a rising loan growth rate is explained by higher funding to some select sectors at cheap rates by the TCMB itself and that access to credit is still difficult for most in Turkey.

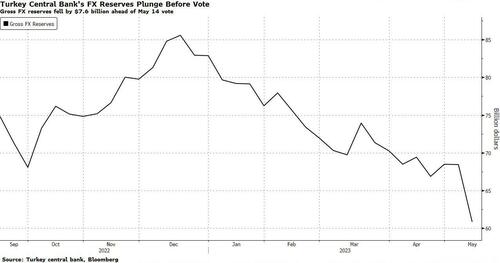

Goldman’s report effectively recaps what happened last week, when Turkey’s gross foreign exchange reserves posted a record fall in the week before Sunday’s inconclusive elections, as the central bank expanded efforts to support the lira.

The reserves dropped by $7.6 billion in the week to May 12 to $60.8 billion, central bank data showed — the biggest weekly fall in the figures going back to 2000. Net reserves as defined by the IMF, including swaps, also fell to $2.3 billion, the lowest in over two decades.

The data mark an acceleration in attempts to defend the currency (which in turn is driven by an accelerating rush by the population to converted increasingly worthless lira into hard currency), seen by citizens as a key barometer of the economy’s health and a major point of contention in the election.

It’s not just FX: Turkey’s five-year credit default swaps climbed 16bps on Thursday, extending this week’s advance to 185bps, climbing to the highest level since Oct. 28, and following last week’s biggest 3-day jump in 2 years. The move in CDS suggests a “challenging picture” for the lira, Istanbul-based Unlu&Co. wrote in its daily report. The rising trend in USD-TRY is “likely to continue in the short-term,” it said.

More in the full note available to pro subs.

Tyler Durden

Mon, 05/22/2023 – 12:45