ETF Put Open Interest Hits Record High, Surpassing August 2011 Debt Ceiling Crisis Total

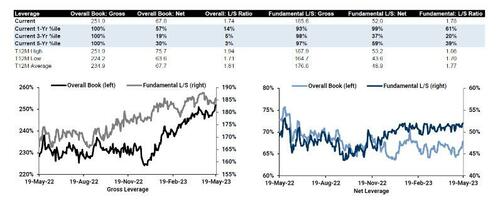

Over the weekend we discussed our observation of the first tangible shift in investor sentiment, when not only did Goldman’s Prime Brokerage note the biggest increase in both Gross and Net leverage across hedge funds, but also witnessed the largest net buying in 4 months, as long buys outpaced short sales (~4 to 1).

This matters, because it showed that first the first time, hedge funds were not fighting the tape and instead of shorting the rally, they were trading alongside it, which – as we explained – is bullish for near-term market dynamics if bearish for the longer-term as it meant there would be fewer shorts to be squeezed in coming weeks, and less risk of a gamma squeeze..

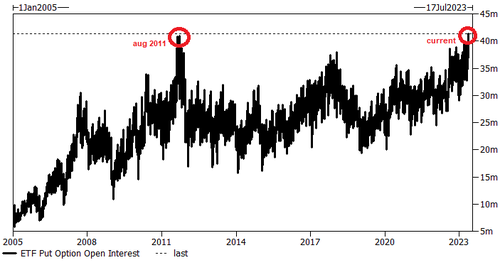

In retrospect, however, maybe this assessment was a bit premature because overnight Goldman’s derivative guru Brian Garrett showed something astounding: as shown in the chart below, the combined put open interest across major equity ETFs stands at 41 million contracts as of last data count.

This, according to Garrett, is the highest ETF put open interest in history (this index tracks 14 most commonly traded instruments, such as XL sector ETFs + SPY, QQQ, etc.)

The last time put open interest approached these levels was Aug of 2011 when readers will recall was the last major debt ceiling crisis, one which prompted S&P to downgrade the US credit rating.

Garrett’s conclusion is that the with “implied volatility bottom of the range, and the cost to hedge low (cheap?), the data suggests investors are finally using the option market to protect left tail.” Which, of course, is just the opposite of what Goldman’s prime brokerage found, when it concluded that investors are finally moving away from obsessing over downside protection and joining the upside momentum chase.

Who is right: the hedge fund flow strategist or the derivatives guru? We’ll find out the answer after the we get the market dump as the debt ceiling crisis peaks and then the inevitable rebound as the debt ceiling is lifted once again.

Tyler Durden

Tue, 05/23/2023 – 12:45