Withdrawing Your Own Cash? NatWest Bank Wants To Know Why… And See Proof

Authored by Mark Jeftovic via BombThrower.com,

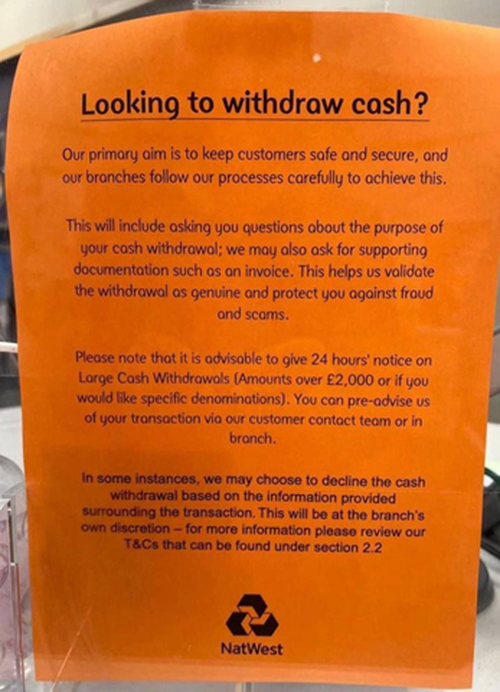

A reader sent me this graphic which is circulating on social media.

Whenever I see an unattributed image like this going around I want to verify it, lest it be photoshopped, a deep-fake or some derivation of “urban legend”.

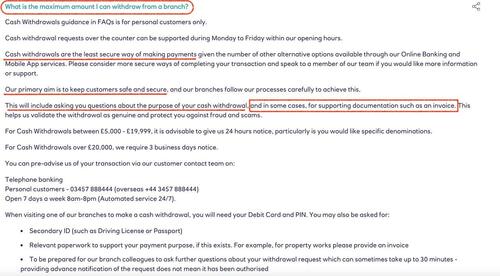

Sure enough, if you go to NatWest bank’s website, right here – you see this cash withdrawal policy spelled out for all to see:

This isn’t actually new

Here in Canada, for at least a few years – predating COVID, the big four banks have been routinely asking you why you are taking cash out whenever you withdraw anything over a couple thousand dollars. However, you can tell them pretty well anything (“because I want it”, “none of your business” or even “to blow it all on booze and hookers”, will all work). I haven’t heard of a case where a withdrawal has been denied based on the reason supplied, yet.

But now that we’re starting to see it formalized in policy language of banks, we can all see where this is going.

The war on cash has been in full swing for a long time, India banned large denominations bills in 2016 and will now start eliminating them from the monetary base. France has been signalling a prohibition on cash payments over 1,000 francs since 2013 and finally, quietly, it seems, made it part of the framework this year.

It portends a wider initiative across the entire Eurozone (who is also trying to lump in crypto payments under the restrictions).

This is all to lay the groundwork for the march into Central Bank Digital Currencies (CBDCs) which will seek to accomplish three objectives of Late-Stage Globalism:

Eliminate privacy – making all transactions trackable, traceable and taxable in realtime.

Introduce controls on how, when and why you are spending your own money. Think China-style social credit, which in its Westernized form will almost certainly involve personal carbon footprint quotas.

And most importantly (otherwise we wouldn’t be calling it “Late Stage Gobalism”):Extend the runway of fiat currencies – which are about to hit the wall as a long-wave debt super-cycle reaches its crescendo.

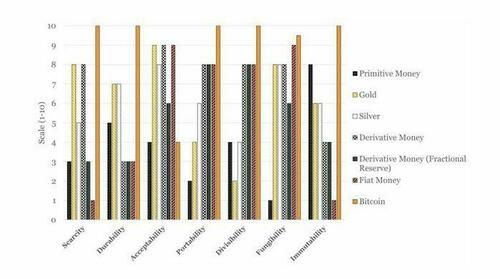

The antidote to all this, is of course, Bitcoin. The only digital asset that is scarce, truly decentralized, has frictionless portability, and is backstopped in physical reality (the “7th property”) in away gold isn’t. It embodies all other properties of sound money:

Via “The 7th Property: Bitcoin and the Monetary Revolution” by Eric Yakes

There are still many who scoff at the idea of “magic internet money” becoming viable at all, let alone the main bulwark against the coming CBDCs. We know cash is doomed, we know any state or central bank issued digital substitutes will simply be linear, digital extensions of fiat: backed by nothing, based on debt, but with added layers of technocratic surveillance and control.

With the mother of all economic recessions dead ahead (if not here already), and the fiat banking system more or less insolvent, the value proposition for CBDCs (a.k.a subservience-tokens) will be Universal Basic Income, with all encompassing strings attached.

Anybody relying on the State for their economic subsistence will have their lives gamified via their smartphones, their carbon footprints metered, their energy usage subject to approval. Such will be the life of a CBDC-serf.

When those days come, the bank won’t have to ask you why you want some of your own money and how you are going to spend it.

You’re the one who will have to ask them …for permission.

* * *

My next ebook is The CBDC Survival Guide and I’m sending it free to Bombthrower subscribers when it’s done (early June). In the meantime, subscribe now and get The Crypto Capitalist Manifesto while you wait. Follow me on Nostr, or Twitter.

Tyler Durden

Wed, 05/24/2023 – 20:10