Q1 GDP Revised Greater As Core PCE Comes In Hotter Than Anticipated

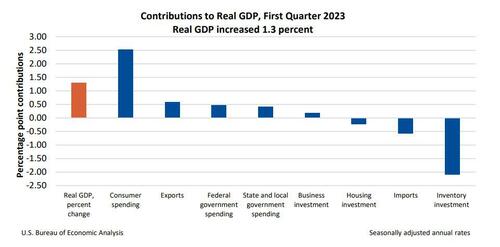

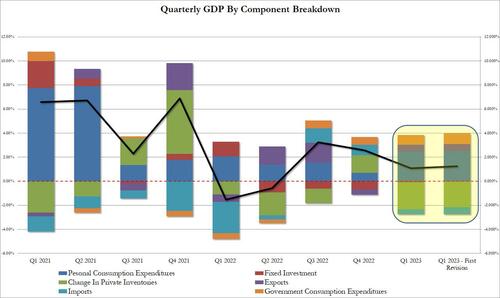

Within the second estimate of Q1 GDP, the BLS reported a that the US financial system grew at an annual fee of 1.3%, up from 1.1% within the advance estimate printed a month in the past and down from the two.6% progress fee in This fall of 2022.

The rise within the first quarter primarily mirrored a rise in client spending that was partly

offset by a lower in stock funding.

- The rise in client spending mirrored will increase in each items (led by motor autos and components) and providers (led by well being care, meals providers and lodging, in addition to monetary providers and insurance coverage).

- The lower in stock funding primarily mirrored decreases in wholesale commerce and manufacturing.

In comparison with the fourth quarter, the deceleration in actual GDP primarily mirrored a downturn in stock funding and a slowdown in enterprise funding. These actions had been partly offset by an acceleration in client spending, an upturn in exports, and a smaller lower in housing funding. Imports turned up.

Particularly, listed here are the adjustments to the underside line GDP print:

- Private Consumption added 2.52% to the underside line 1.3% GDP print, up from 2.48% within the advance estimate

- Mounted Funding subtracted simply -0.03%, an enchancment from the unique print of -0.07%. Nonetheless, that is the 4th consecutive quarter of declines in fastened funding

- The change in non-public inventories added 0.58%, up from 0.54%.

- Internet exports (exports much less imports) added a tiny 0.01%, down from 0.11% within the advance estimate

- Lastly, authorities spending “added” 0.89%, up from the unique estimate of 0.81%.

Backside line, Q1 GDP rose 1.250%, rounded as much as 1.3%.

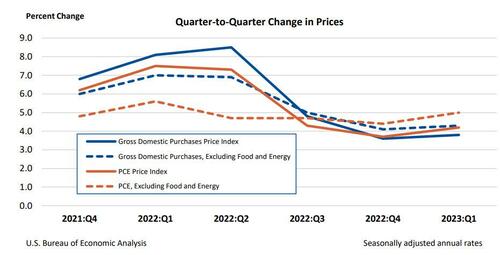

Whereas the change in GDP shall be principally ignored as it’s a very stale knowledge level, there could also be some consideration to the value index and core PCE, each of which got here in barely larger than anticipated:

- GDP Value Index 4.2%, Exp. 4.0%, up from 3.7% in This fall

- Core PCE Q/Q 5.0%, Exp. 4.9%, up from 4.4% in This fall

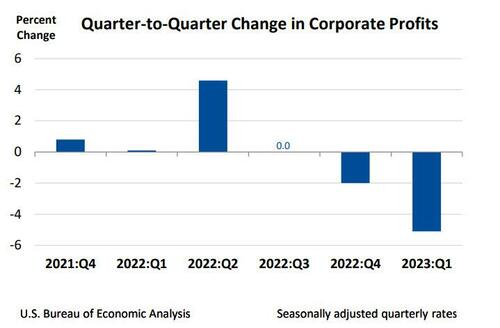

The BLS had much less excellent news when taking a look at company earnings which fell 5.1% Q/Q (after lowering 2.0% within the

fourth quarter) and decreased 2.8% within the first quarter from one yr in the past.

- Income of home monetary companies decreased 6.3 % after lowering 12.8 %.

- Income of home nonfinancial companies decreased 5.3 % after lowering 1.1 %.

- Income from the remainder of the world (web) decreased 3.5 % after rising 4.8 %

- Federal Reserve financial institution earnings up 116.3% in 1Q after falling 241.6% prior quarter

General, a barely stronger Q1 though it seems to merely pull demand from the longer term, whereas the upper than anticipated core PCE shall be carefully watched by the Fed, and positive sufficient, moments in the past the market seems to have absolutely priced in yet another full hike in June.

- *FED SWAPS SHOW QUARTER-POINT HIKE FULLY PRICED BY JULY MEETING

However whereas usually this might have despatched shares sharpy decrease, a burst of unfounded optimism a few debt deal following some cheerful feedback from McCarthy, to not point out the explosion in Nvidia, is pushing futures to session highs, extra fee hikes be damned.

Tyler Durden

Thu, 05/25/2023 – 09:00