OPEC Credibility On The Line With Discuss Of Extra “Ouching”

By John Kemp, Reuters senior power analyst

Saudi Arabia’s power minister has warned speculators to “be careful” – an implied risk to chop manufacturing once more to drive costs increased when ministers from the expanded OPEC? group of exporters meet on June 4.

“I hold advising them (speculators) that they are going to be ouching, they did ouch in April, I don’t have to indicate my playing cards, I’m not a poker participant … however I might simply inform them be careful,” Vitality Minister Prince Abdulaziz bin Salman stated at a convention on Might 23.

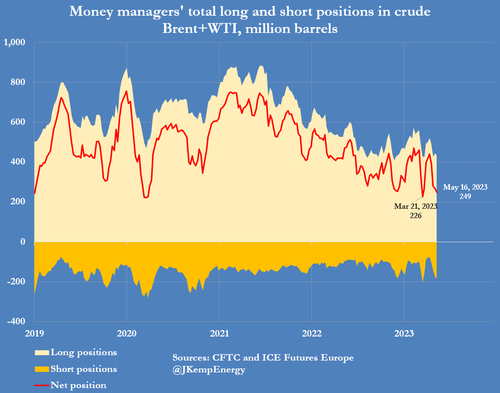

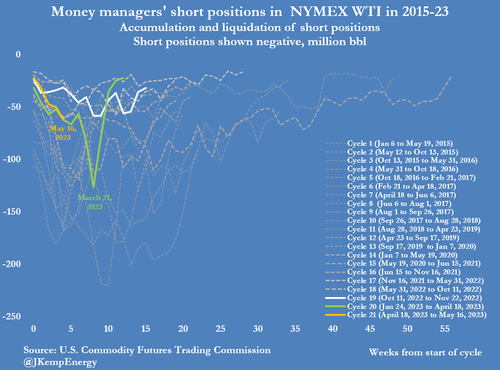

Whole hedge fund brief positions within the three major Brent and WTI futures and choices contracts had greater than doubled to 184 million barrels on Might 16 from 79 million 4 weeks earlier.

In a marked turnaround in sentiment, bullish fund positions outnumbered bearish brief ones by a ratio of two.35:1 (thirteenth percentile for all weeks since 2013) down from 6.62:1 (82nd percentile) on April 18. Even so, shorts have been nonetheless beneath the current excessive of 204 million barrels in late March earlier than Saudi Arabia and its OPEC+ allies squeezed them by unexpectedly saying an output minimize of greater than 1 million barrels per day.

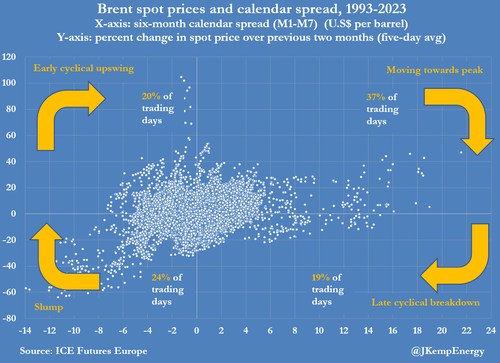

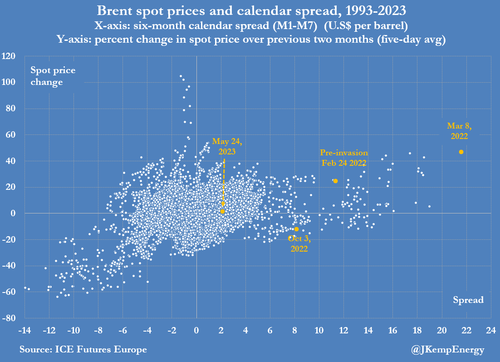

The risk posed by the approaching ministerial assembly, amplified by the minister’s feedback, has seemingly contributed to the slight rise in front-month Brent futures costs and calendar spreads in current days.

But it surely additionally means merchants have began to cost within the chance of not less than some manufacturing cuts being introduced on the subsequent assembly.

Build up expectations on this means may show dangerous. OPEC+ will seemingly have to chop its manufacturing targets or threat being thought to have made an empty risk.

If OPEC+ ministers determine to go away their manufacturing goal unchanged, costs and spreads are more likely to retreat as their bluff is named.

BATTLING THE TIDE

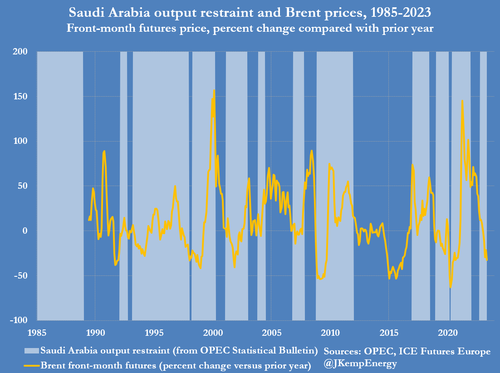

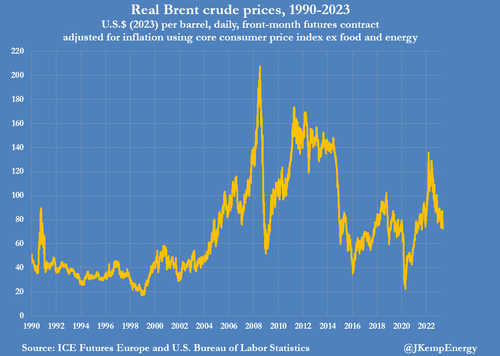

Saudi Arabia and its OPEC+ allies have been battling to stem the downward strain on oil costs since September and October 2022 after they began to cut back their manufacturing targets.

However the enterprise cycle slowdown throughout the most important economies has exerted a lot downward power that OPEC? has had solely modest success in offsetting it.

Entrance-month futures costs and calendar spreads often rise when OPEC restrains output, not less than for a time, till self-discipline inside the cartel begins to slacken.

On this occasion, nonetheless, costs and spreads have continued to melt regardless of a number of bulletins that lowered output in contrast with the earlier goal.

In the beginning of October 2022, front-month Brent futures have been buying and selling round $90 per barrel whereas the six-month calendar unfold was in a backwardation of virtually $8.

Since then, OPEC? members have minimize their collective goal by virtually 3.6 million barrels per day, however the front-month worth has slipped to $78 and the unfold is right down to $2.

A number of components have mixed to create intense downward strain on oil costs:

- Russia’s petroleum exports have remained increased than anticipated because of a relaxed method to enforcement of EU and U.S. sanctions.

- China’s financial rebound from coronavirus lockdowns and the exit wave of the pandemic has been slower than predicted.

- Manufacturing and freight exercise throughout North America and Europe have weakened – slicing consumption of each crude and center distillates corresponding to diesel.

- Persistent inflation has pressured the U.S. Federal Reserve and different central banks to raise rates of interest increased for longer to carry worth will increase again underneath management.

- The U.S. regional banking disaster that erupted in March with the failure of Silicon Valley Financial institution threatens to compound the tightening of economic situations and extend the enterprise cycle downturn.

OPEC+ manufacturing cuts have averted a giant improve in oil inventories and a steeper fall in costs and spreads, however they haven’t but been sufficient to spice up them, besides within the brief time period.

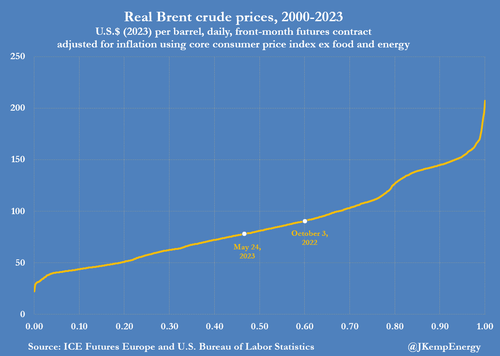

Adjusted for inflation, front-month Brent futures costs are within the forty seventh percentile for all buying and selling days since 2000, down from the sixtieth percentile in the beginning of October 2022.

By stopping a giant rise in world petroleum inventories, OPEC? is creating situations for a sooner rebound in costs later in 2023 or in 2024.

However a sturdy rise in costs and spreads is ready for some mixture of decrease petroleum exports from Russia and/or an enchancment within the financial atmosphere.

Tyler Durden

Thu, 05/25/2023 – 09:10