Oil Tumbles After Russia’s Novak Alerts No New Manufacturing Lower From OPEC+

It seems that OPEC’s credibility is about to take a giant hit.

As we mentioned earlier, following feedback from the Saudi power minister that oil shorts can be “ouching” quickly, the market interpreted this as an indication that OPEC+ would proceed with one other output reduce following the sudden transfer in early April which briefly despatched oil costs sharply increased. The choice can be one other painful blow to OPEC’s credibility, which has emerged as a form of jawboning “central financial institution” for the commodity.

However in a single day, oil bulls had been served a chilly bathe by Russian Deputy Prime Minister Alexander Novak who mentioned he anticipated no new steps from OPEC+ when it meets in Vienna on June 4, the state-owned information company RIA reported.

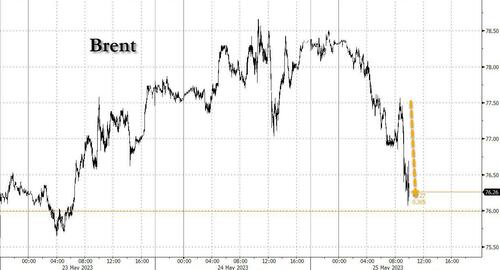

As Bloomberg’s Grant Smith notes, the contradictory alerts on oil coverage from OPEC+ leaders Saudi Arabia and Russia counsel the group in all probability gained’t agree new measures subsequent week. That’ll do little to enhance souring sentiment in crude markets, and positive sufficient oil has plunged on Thursday, erasing all current losses.

Russia, which wants oil revenues to fund its warfare on Ukraine and which the west is gladly funding as Biden has made clear his reelection probabilities will collapse if oil costs soar if Russian oil provide is instantly halted, has to this point struggled to implement manufacturing cutbacks it introduced months in the past. Agreeing to even deeper curbs at this level could be greater than Moscow can countenance.

It’s attainable that the Saudis and fellow Gulf exporters may resolve to maneuver with out Russian help, however provided that they’ve already shouldered a lot of the burden for supporting oil markets this yr, they could really feel reluctant to do extra.

The rhetorical schism between Riyadh and Moscow is a reprise of positions taken by the 2 sides ever since they shaped OPEC+ simply over six years in the past, with the Saudis prepared for motion and Russia advocating a extra reasonable stance.

Regardless of dousing expectations for extra manufacturing cuts, Novak mentioned he anticipated Brent value to be above $80 a barrel by the tip of the yr. He mentioned present costs of $75-76 mirrored the market’s evaluation of the worldwide macroeconomic scenario. Novak additionally mentioned that prime U.S. rates of interest and a slower than anticipated Chinese language financial restoration had been holding again oil costs from rising additional.

“This would be the first face-to-face assembly in six months, we’re ready, as regular, for an evaluation of the scenario available in the market,” Novak was quoted as saying by Izvestia newspaper.

“However I do not assume that there can be any new steps, as a result of only a month in the past sure choices had been made relating to the voluntary discount of oil manufacturing by some nations because of the truth that we noticed the sluggish tempo of worldwide financial restoration.”

He additionally mentioned he hoped that oil demand will enhance in the summertime.

“However I repeat as soon as once more: we don’t have the duty of inflating costs – there’s the duty of balancing with a view to make sure the pursuits of each producers and customers.”

Sending one other sign that no motion could be required from OPEC+ at its subsequent assembly, Russian President Vladimir Putin mentioned on Wednesday that power costs had been approaching “economically justified” ranges.

Putin mentioned this month that manufacturing cuts carried out by OPEC+ had been required to take care of a sure value stage, contradicting assurances from different leaders of the group that it was not in search of to handle the market in that manner.

Oil costs had been little modified on Thursday as uncertainty over whether or not the USA will keep away from a debt default weighed in opposition to the prospect of additional OPEC+ manufacturing cuts.

Tyler Durden

Thu, 05/25/2023 – 10:30