Banks & Bond Yields Jump On Goolsbee, Gensler, Biden, Bostic, & Bad Data

Today’s terrible, horrible, no good Empire Fed Manufacturing survey pushed the US Macro Surprise Index into the red, extending an almost non-stop decline over the past 7 weeks…

Source: Bloomberg

Debt Ceiling anxiety continues to soar with USA Sovereign risk remaining at record highs…

Source: Bloomberg

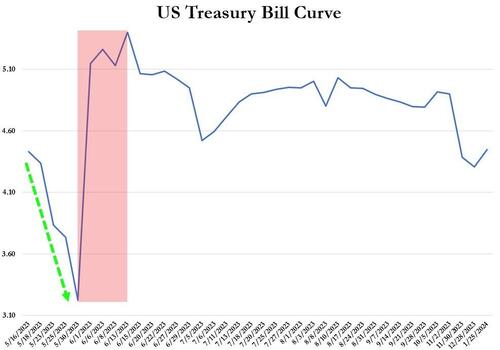

And the T-Bill curve incredibly discontinuous…

Stocks started off weak after Fed’s Goolsbee warned that SVB was watching the market and bet that the market was right (so lifted its rate hedges) as opposed to The Fed’s forecast (and subsequent actions).

Biden said he will meet Congressional leaders tomorrow (Tuesday) to discuss the debt ceiling and that seemed to send stocks higher around 1300ET (even though there was nothing new in that comment at all).

1325ET SEC’s Gensler said that there was no short-selling ban currently being weighed for US stocks (and rightly so because the last time they did that it triggered a massive wave of long liquidations).

1400ET Fed’s Bostic reconfirmed his ‘high for longer’ hawkish attitude by noting that he would probably vote to hold rates for now (but does not see cuts any time soon).

1410ET McCarthy warned that debt talks “nowhere near reaching a conclusion.”

Bear in mind that CNBC did its very best to spin some marginally positive comments by Paul Tudor Jones today as being wildly bullish… they were not.

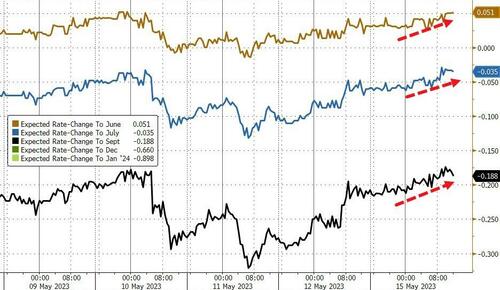

Bostic and PTJ say ‘The Fed is done’ but Bostic sees rates here for a while with no cuts soon BUT PTJ sees recession in H2 (which suggests rate-cuts may be on the table). The STIRs market inched hawkishly towards Bostic and not PTJ today.

Source: Bloomberg

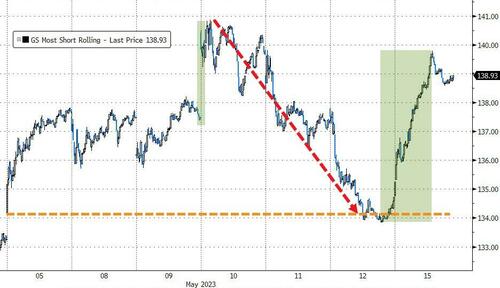

“Most Shorted” stocks soared almost 5 off Friday’s lows…

Source: Bloomberg

Juiced by multiple waves of 0-DTE positive delta pulses…

VIX1D tumbled back near recent lows as extreme-local event risk disappears…

Source: Bloomberg

Regional banks were the big gainers (because Friday’s deposit data showed more outflows?? or because no banks blew up this weekend? Or just a squeeze again)…

Which helped drive Small Caps to be the day’s winners among the US Majors. The Dow lagged (but closed marginally higher after being down 10 of the last 11 days)…

Treasuries were dumped again with the long-end weakest (30Y +5bps, 2Y +1bps), but note that when the crappy Empire Fed data hit, yields plunged…

Source: Bloomberg

2Y Yields held at 4.00%…

Source: Bloomberg

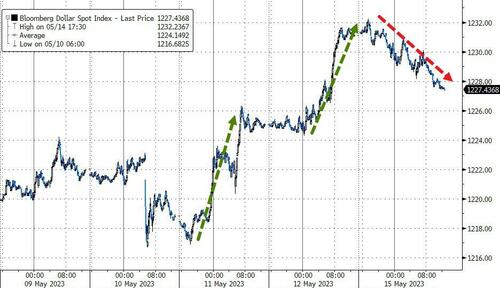

The dollar drifted lower after two strong days…

Source: Bloomberg

Bitcoin bounced modestly on the day, back above $27,000…

Source: Bloomberg

Spot Gold modestly extended its bounce off $2000 from last Friday…

Source: Bloomberg

And oil prices jumped today with WTI bouncing after tagging a $69 handle…

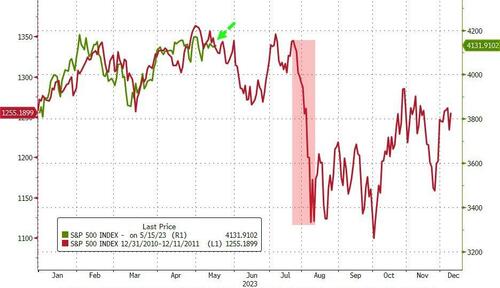

Finally, “you are here”…

Source: Bloomberg

Just remember, it’s different this time, right!

X-date outlook is worsening as FDIC withdrew $12bn on May 4-5 from TGA & Treasury released new estimates of extraordinary measures remaining. Looking like $20bn cash on hand at end of day on June 1 (old expectation was $38bn) https://t.co/Zf6dIaBIkQ pic.twitter.com/cbF3LVdiwW

— Donald Schneider (@DonFSchneider) May 15, 2023

Tyler Durden

Mon, 05/15/2023 – 16:01