Banks Bounce Again As Massive Short Squeeze Lifts Stocks; Bonds Battered

Having ignored Target’s clear signals that the consumer is in trouble, hopes for a Debt Ceiling debacle resolution and a PR statement from a regional bank about deposits (WAL), combined with a 0-DTE-inspired short-squeeze, sparked a big day for banks (and thus small caps) and as the broad stock markets squeezed higher, bonds were dumped along with gold.

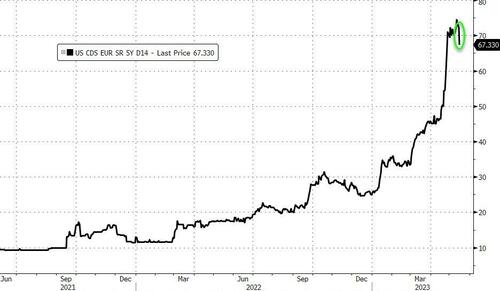

US Sovereign risk retreated a smidge…

Source: Bloomberg

Regional banks surged (but stalled at a key resistance level)…

As ‘most shorted’ stocks squeeze hard (also up to a key technical level)…

Source: Bloomberg

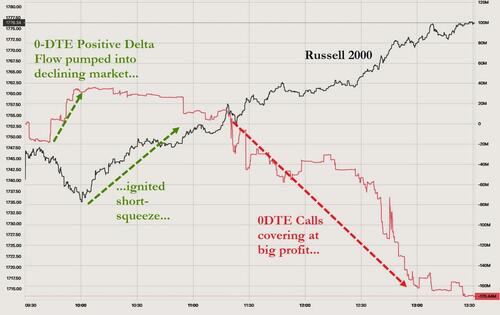

Ignited by a big push from 0-DTE traders in the Russell 2000 at the open…

All of which lifted all the majors higher with Small Caps the biggest gainer…

After being rangebound (between the 50- and 100-DMAs), The Dow broke out to the upside today (but faded late on)…

Treasuries were sold again today with the short-end underpeforming (2Y +6bps, 30Y +2bps)…

Source: Bloomberg

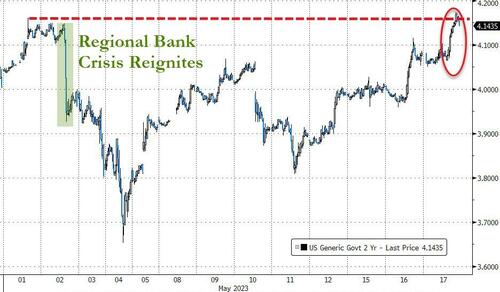

The 2Y Yield soared up to 3-week highs and stalled (right before the regional bank crisis scare re-emerged)…

Source: Bloomberg

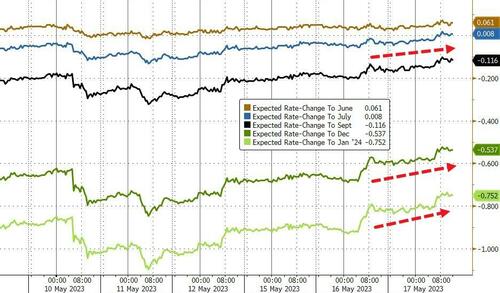

Fed rate change expectations continued to trend hawkishly (though only modestly), but rate-cut expectations later in the year are falling quickly…

Source: Bloomberg

The dollar rallied today, testing the early April highs before rolling over…

Source: Bloomberg

Bitcoin surged today after testing down to $26,600

Source: Bloomberg

Oil soared today, despite a big crude build, as debt ceiling anxiety may have lifted optimism and pushed WTI back above $73…

Gold broke down below $2000 (Futs), back to six-week lows…

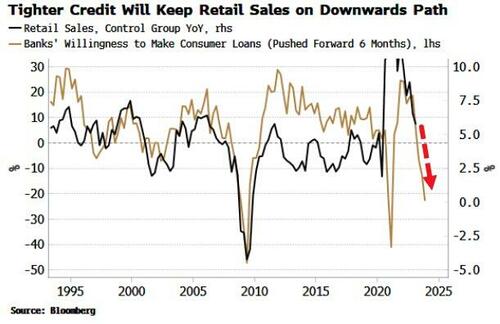

Finally, today we heard from Target about just what a shitshow the consumer is in Q1.. worse in March… and worserer in April…but the spin was that yesterday’s retail sales data proved they are resilient. That’s true except its noise as Bloomberg’s Simon White notes, the trend is not your friend at all for spending…

Source: Bloomberg

Banks are less willing to make consumer loans, and this points to retail-sales growth continuing to weaken fairly steeply through the rest of the year.

Tyler Durden

Wed, 05/17/2023 – 16:00