Taxpayers Fleeced Again? Big Banks Push New FDIC Re-Funding ‘Trick’

Never let a crisis go to waste…

Not satisfied with the billions in interest they’re earning on excess reserves, or the unlimited facilities The Fed opened up with the BTFP to bail out regional banks’ losses on their bond portfolios, The Wall Street Journal reports that banks have spent the past week or so testing a cunning plan to push more losses on to the US taxpayer.

Instead of paying the billions of dollars they collectively owe to replenish the federal deposit insurance fund, they want to use Treasurys instead of cash.

Sounds good right…

…except those Treasuries are trading notably below par and the government will accept them as par, implicitly paying a premium for the bonds.

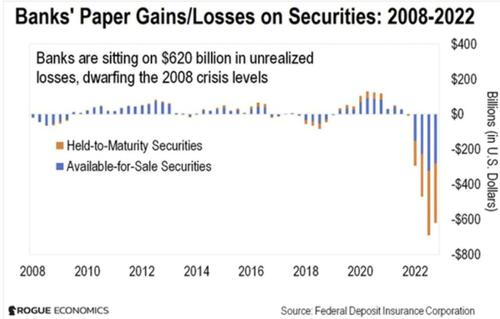

As a reminder, US banks are sitting on $620 billion in unrealized paper losses on government bonds…

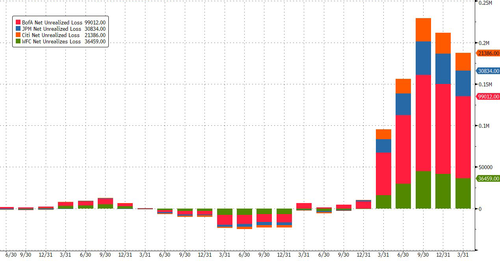

And the ‘Big 4’ – who will pay the biggest “fees” to replenish the FDIC fund are sitting on these unrealized losses which they would love to swap for par to some sucker…

This would put even more of the banks’ balance-sheet-clogging losses on the US taxpayer’s shoulders.

This is a nuanced (but crucial) difference to the Bank Term-Financing Plan (BTFP) which offers a loan or swap for the discounted bonds at par…with a limited horizon (which will always be extended though) – instead o this FDIC debacle which is simply a trade – bank gives FDIC 90c bond for every $1 it owes them!

At issue is a so-called special assessment the FDIC has proposed for large banks to recoup losses to the deposit insurance fund tied to two big institutions that collapsed in March.

The agency is soliciting public comment on the proposal for about two months.

Wall Street Journal reports that an FDIC spokeswoman said the agency’s rules don’t allow banks to pay it in Treasurys.

But the FDIC welcomes public comment on its rules, she said.

Which sounds a lot like “ok, great idea.”

According to people familiar with the proposal, WSJ reports that Paying with Treasurys also would give banks a modest break on their special assessment, if they can get face value for bonds that have declined about 10%. Supporters say the government would hold the securities until maturity, allowing them to recover principal and interest on the debt.

The government (US taxpayer) would suffer no losses, they say.

Sure…

So let’s just clarify:

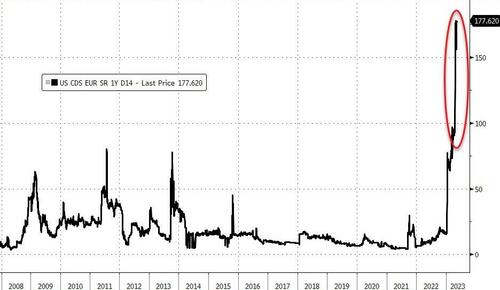

When yields decline the banks gain as bond prices rise…

…but when rates go up (and bond prices decline and crush their balance sheets) they demand a bailout at par (because, hey, USTs will ‘never default’ right and will be ‘money good’ sometime in the future).

USA sovereign risk right now…

In the meantime, we have a quick question – can US taxpayers pay their taxes in the same manner – with bonds trading below par? Asking for a friend.

Tyler Durden

Wed, 05/17/2023 – 15:25