Report ID’s Money Managers Most, Least Likely To Back ESG Resolutions

A new report from a group championing supply-side economics reveals which investment management companies vote most and least often in favor of woke shareholder proposals advancing the broad environmental, social and governance (ESG) agenda.

Titled “Putting Politics Over Pensions,” the 40-page analysis comes from the Committee to Unleash Prosperity, which was founded in 2015 and is led by Steve Forbes, Art Laffer, Steve Moore and Phil Kerpen.

“We examined hundreds of major shareholder proposals and trimmed that list to what we call the ‘Fiduciary-Free 50,’ which were the most radical proposals related to left-wing activism,” the group explains in its report. “None of these proposals were supported by management at the targeted companies.” Their ranged from diversity hiring-quotas, to oil and gas divestment, plastic bans and “net zero” emissions.

One example: Shareholders proposed that Costco “adopt short, medium, and long-term science-based greenhouse gas emissions reduction targets, inclusive of emissions from its full value chain (Scope 1, 2, and 3), in order to achieve net-zero emissions by 2050.” In a Tuesday op-ed, Forbes and Moore asked, “What does this have to do with selling groceries?”

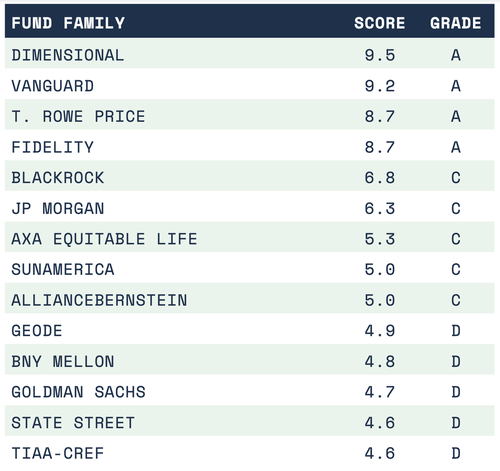

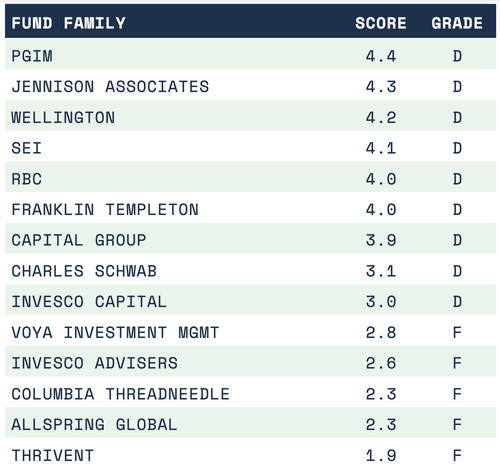

Next, researchers calculated the percentage of times a given money management firm voted in favor of these “most egregious examples of policy mandates that would interfere with management’s quest to maximize returns.” From that, grades were handed out — from A’s for firms voting overwhelmingly against ESG proposals to F-‘s for those rubber-stamping the destructive leftist rubbish.

Out of the 40 largest money managers, only four earned an A by voting against nearly all ESG offerings. In order of highest-score first, they were Dimensional Fund Advisors, Vanguard, T. Rowe Price and Fidelity.

At the other end of the spectrum, 17 of the top-40 managers earned an F or F-, including Invesco, UBS, American Century, Deutsche Bank, Northern Trust and — at the very bottom of the barrel — Paris-based BNP Paribas. No firms earned a B. The world’s largest money manager, BlackRock, scored a C. State Street got a D.

“This information should be of great value to mom-and-pop investors as they choose what firms to manage their money,” write Forbes and Moore, noting “the vast majority…don’t want politics and ideology to interfere with their money managers earning the best return possible for their retirement.”

The report should also help those who rail against ESG to be more precise in throwing condemnation at investment management firms. Specifically, from politicians to pundits to ZeroHedge commenters, many wrongly include Vanguard in lists of the worst ESG villains, while the Committee to Unleash Prosperity’s analysis found the opposite to be true.

Just last week, GOP presidential hopeful Vivek Ramaswamy unjustly threw Vanguard under the ESG bus, telling an audience, “The three largest asset managers are BlackRock, State Street and Vanguard…they’re using $20 trillion of our money to force American companies to adopt racial equity programs and emissions caps.”

Vanguard has been steering its ship back toward sanity on this front. Earlier this year, Vanguard withdrew from the $59 trillion Net Zero Asset Managers initiative, an organization that’s part of the $150 trillion United Nations-affiliated Glasgow Financial Alliance for Net Zero.

“We don’t believe that we should dictate company strategy,” CEO Tim Buckley said at the time. “It would be hubris to presume that we know the right strategy for the thousands of companies that Vanguard invests with. We just want to make sure that risks are being appropriately disclosed and that every company is playing by the rules.”

The Committee to Unleash Prosperity study also looked at voting by state pension funds, and the findings were predictably grim: Collectively, they backed 85% of climate resolutions and 93% of social-justice proposals. Support was strong even in Republican-leaning states.

The full report scores 772 money managers in an alphabetical-order listing that starts on page 22. In a lopsided barbell distribution separating the woke from the fiscally rational, 62% scored D’s and F’s, and 26% scored an A. Just 12% received a B or C. Here’s a look at the 40 largest firms:

Tyler Durden

Thu, 05/18/2023 – 06:55