“They’re Just Unreasonable”: Debt Ceiling Talks Collapse As Republicans “Abruptly” Walk Out Of Negotiations

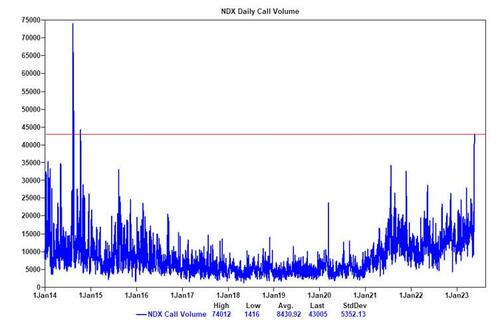

Yesterday, when explaining the real reason for Thursday’s tech-led meltup – which for those who missed it was the biggest call buying spree-cum-gamma squeeze since 2014…

… we mocked those idiots who blindly parroted the ridiculous narrative that debt ceiling talks were “going well” (once again for the very cheap seats: “We Won’t See A Debt Ceiling Solution Until The Market Panics“) for the simple reason that, as we went on to say, there would be NO DEAL until the market freaked out, to wit:

But before someone idiotically tosses that today’s meltup was because of more good news on the debt ceiling negotiations (there was zero news, neither good nor bad, and we hate to break it to you but there will be no debt ceiling deal until after the market freaks out, so enjoy the frenzied rush higher), the primary explanation for today’s move was simple: the biggest nasdaq gamma squeeze since 2014!

Well, today the idiocy continued and there were those who once again blindly parroted the narrative that debt ceiling talks are going great and debt deal optimism is pushing stonks higher.

Just one problem…

… it was – as we warned repeatedly – all a lie, and moments ago Bloomberg reported what we all know would come out sooner or later (it ended up being sooner), that the talks have pretty much collapsed after House Speaker Kevin McCarthy’s top debt-ceiling negotiators “abruptly left a closed-door meeting with White House representatives soon after it began Friday morning, throwing the status of talks to avoid a US default into doubt.”

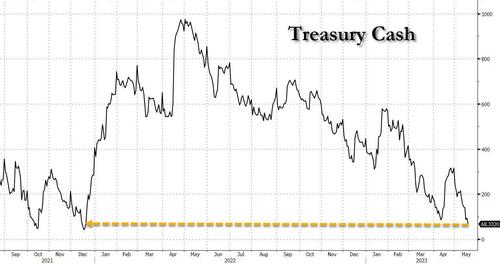

“Look, they’re just unreasonable,” Republican Representative Garret Graves said, adding that the talks were on a “pause.” He added that he did not know if the negotiators would meet again Friday or over the weekend, which is a problem because as we showed last night, the Treasury cash is now down to just $18 billion away from the Treasury’s critical cash level of $50BN, and at this rate, the Treasury will run out of cash in a few days.

“Unless they are willing to have reasonable conversations about how you can actually move forward and do the right thing, we’re not going to sit here and talk to ourselves,” Graves said, as House Financial Services Committee Chairman Patrick McHenry stood near him.

Graves’ comments come one day after McCarthy said he could see a deal coming together with a House vote next week (narrator: he was only jawboning for political purposes; there will be no deal next week). And yet, the 19 year old woke portfolio managers took McCarthy’s comments as his most positive yet on the negotiations to avoid a default, and bid risk up like the useful little liquidity providing idiots they are.

Fox confirmed BBG’s reporting:

2) Fox is told there is a lack of movement between the sides over what Republicans want to cut on the “discretionary” side of the ledger. This is the part of spending which Congress controls through the appropriations process each year.

— Chad Pergram (@ChadPergram) May 19, 2023

4) Meantime, Republicans are sticking to their position of wanting to increase defense spending.. which is the largest portion of overall discretionary spending – accounting for more than half.

So, that has led to the impasse.

— Chad Pergram (@ChadPergram) May 19, 2023

5) Steep cuts to entitlement programs – which make up the bulk of all spending (close to 70 percent) are off the table. So the only place to go are toward entitlements.

“There is too much daylight between the sides,” said one GOP source.

— Chad Pergram (@ChadPergram) May 19, 2023

Stocks naturally tumbled on the Bloomberg news, with the S&P 500 Index down 0.2% as of 11:30 a.m. in New York. That’s despite Federal Reserve Chair Jerome Powell having said, at a separate event, that the central bank might not need to raise interest rates as high —thanks to potential credit tightening after recent issues in the banking sector.

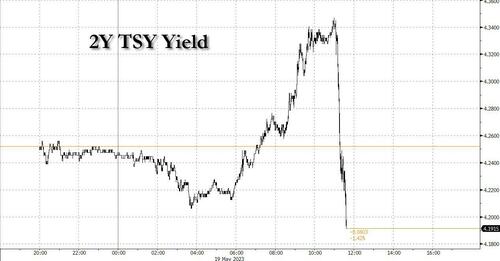

Elsewhere, 2Y yields plunged, reversing all of the days move and then some…

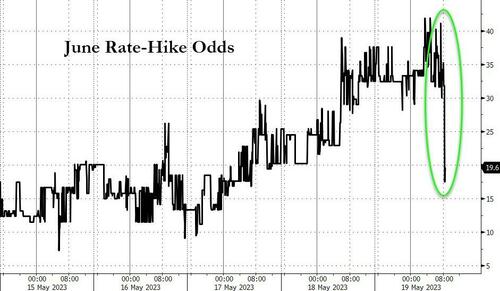

… as June rate hike odds were monkeyhammered…

… while gold – which for some bizarre reason had been sold on “DeBT tALkS OptiMiSM” – soared.

Tyler Durden

Fri, 05/19/2023 – 11:48