Euro, Cable Tumble After Ugly PMIs; Manufacturing Weakest Since COVID Lockdowns

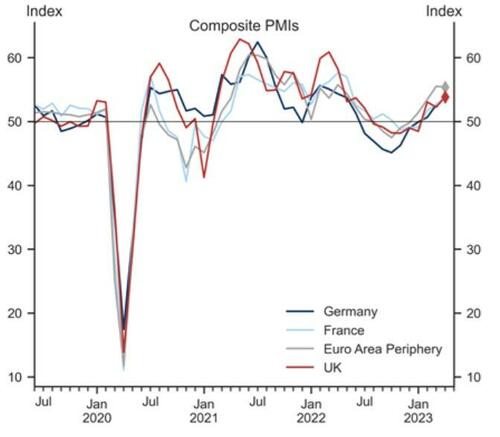

The Euro area composite flash PMI dropped 0.8 to 53.3, below consensus expectations. The decrease in the composite index was broad-based across sectors but skewed heavily towards manufacturing, where the output index fell deeper into contractionary territory – at its weakest since the COVID lockdowns.

Both Manufacturing and Services fell in the preliminary May data…

Source: Bloomberg

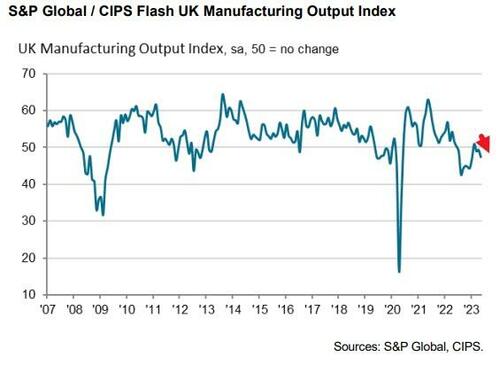

For context, the Manufacturing is a shitshow…

We note that the outperformance of services relative to manufacturing was the widest observed since January 2009 and the new orders divergence is even greater:

European Mfg – Services New Orders. Ht @AnnaTokar3 pic.twitter.com/pqZPBF8Sji

— AG Analyst (@hump_bear) May 23, 2023

The report adds to mounting evidence that the manufacturing woes of Germany, Europe’s biggest economy, are an increasing drag on the wider region.

The composition of the May report showed a broad-based moderation across new orders, employment, new export orders, and backlogs.

Firms’ future output expectations also edged down further

The French composite flash PMI decreased by 1.0pt to 51.4, below consensus expectations. The composite decline was driven by a slowing in the services index, although it remains in expansionary territory, while the manufacturing output index improved to 45.1.

Germany: The German composite flash PMI increased by 0.1pt to 54.3, above consensus expectations. The improvement in the composite index was driven by a further improvement in services activity, while manufacturing output fell back into contractionary territory following three months of slightly above-50 levels.

Periphery: The periphery composite PMI decreased by 1.7pt to 53.6. The composite decline was broad-based across sectors but skewed towards manufacturing, where the output index declined further to remain in contractionary territory (at 45.7), while services index remains in expansionary territory (at 56.5).

Additionally, the UK composite flash PMI decreased by 0.9pt to 53.9, also below consensus expectations. The decline was broad-based across sectors but also skewed more towards manufacturing.

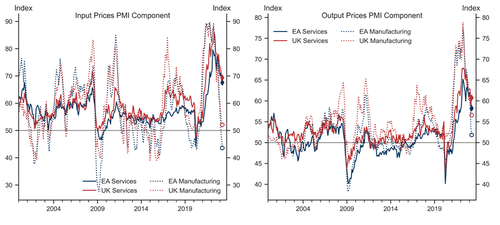

The persistence in domestic price pressures appears even more pronounced in the UK, where input prices faced by services firms also edged up, with the press release noting strong wage growth as the primary driver of this phenomenon.

Goldman notes two main takeaways from today’s data.

First, aggregate growth momentum remains resilient across Europe but this is being driven entirely by strength in services, while activity in the manufacturing sector continues to deteriorate.

Second, price pressures are also becoming increasingly divergent across sectors; while input prices have continued to moderate across both services and manufacturing in the Euro area, prices charged by firms edged up in the services sector. The persistence in domestic price pressures appears even more pronounced in the UK where input prices faced by services firms also edged up, with the press release noting strong wage growth as the primary driver of this phenomenon.

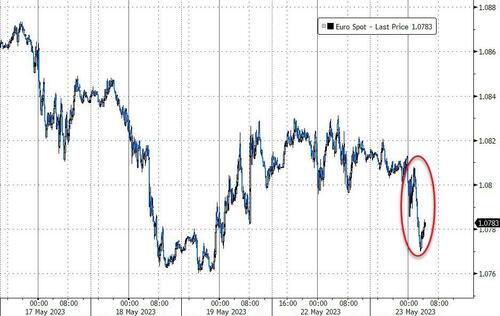

The market’s reaction was swift with EUR and GBP both sold…

“GDP is likely to have grown in the second quarter thanks to the healthy state of the services sector,” Cyrus de la Rubia, chief economist at Hamburg Commercial Bank, said in a statement.

“However, the manufacturing sector is a powerful drag on the momentum of the economy as a whole. German companies from this sector are particularly hard on the brakes.”

Interestingly, for now there has been very little reaction in ECB rate-hike expectations with a June hike still priced at around 25%.

Tyler Durden

Tue, 05/23/2023 – 07:48