“Disruption In DC Is Not Going Away Anytime Soon” – Trillion-Dollar Fund Already Betting On ‘Another’ Debt-Ceiling Debacle

While equity markets remain convinced that a debt-ceiling deal will be done – without the reflexive collapse required to prompt politicians to ‘get back to work’ – not everyone is buying it.

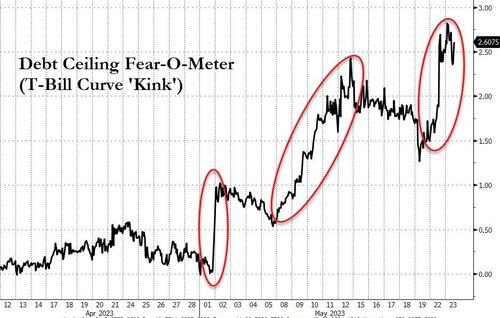

Most explicitly, pressure in the ultra-short-dated T-Bill market is not easing at all with mid-June bills yielding above 6.00% today…

Source: Bloomberg

And additionally, as PGIM Fixed Income Co-CIO Greg Peters notes, those T-Bill wagers simply aren’t worth it for his funds at PGIM Fixed Income, which oversees $793 billion of assets (with PGIM’s total AUM over $1.25 trillion).

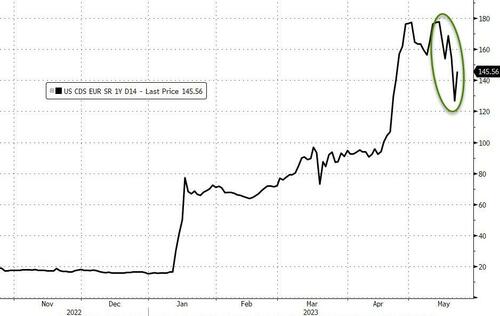

Instead, as Bloomberg reports, he’s focusing on the US CDS curve.

Short-dated USA CDS have compressed modestly in the last week as tone has shifted (more optimistically, despite no actual from Washington), but remain far above prior debt-ceiling debacle highs…

Source: Bloomberg

But, Peters has bought long-dated credit default swaps – insurance against a future default – on the basis that the US will find itself in a similar shitshow again in the not too distant future.

“The US CDS curve is highly inverted, which means people are paying up for default protection in the near term,” he said in a phone interview.

“We went out the curve somewhat, as our sneaking suspicion is that it will continue year after year. The congressional disruption in DC is not going away anytime soon.”

In fact, the ‘cheapness’ of the longer-dated CDS is extreme to say the least…

Source: Bloomberg

While Treasury Secretary Janet Yellen has been fearmongering about imminent default in early June, PGIM has assigned a 5% probability to a default scenario this summer – low, but nonetheless “higher than it should be”, said Peters, who previously worked at the Treasury.

“It’s a very difficult investment thesis because you have this low probability, high catastrophe type of outcome,” he said.

“What do you do with that? It’s like the opposite of a lottery ticket! It suggests being closer to home on your risk.”

Which is practically the exact opposite behavior being exhibited in the equity market

Tyler Durden

Tue, 05/23/2023 – 17:45