Stocks Tumble After Reports Republicans Question Yellen’s X-Date Math

US equity markets appear to finally be facing the reality that the T-Bill market has been preaching – this is far from over.

Early this morning, before the open, Ted Cruz appeared to spook stocks after warning on CNBC that “20-30 year old Marxists” are running the show behind the scenes at The White House, questioning Biden’s cognitive wellness and warning that the odds of an actual default are higher than the market believes, because the ‘behind the scenes’ staffers believe media will back them in blaming Republicans.

Markets limped lower but then a Bloomberg report that House Republicans aren’t buying Treasury Secretary Janet Yellen’s warning that the US government will run out of money as soon as June 1, or her dire predictions of default, undercutting the urgency to raise the debt limit, took markets lower again…

“We’d like to see more transparency on how they came to that date,” House Majority Leader Steve Scalise told reporters after a closed meeting on Tuesday.

“It looks like they’re hedging now and opening the door to move that date back.”

The equity market’s reaction was a push to the lows of the day…

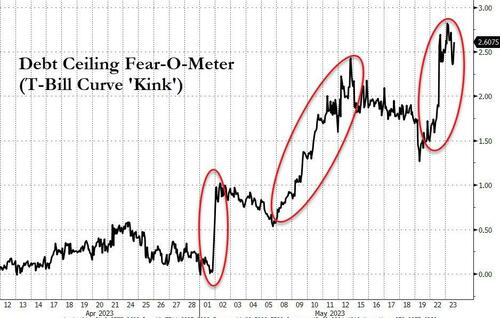

And that is happening as the T-Bill curve’s “kink” reaches a record high…

With mid-June Bills pricing above 6.00%!

As we have noted in detail, Goldman analysts believe June 7-8 as a key danger zone, and Morgan Stanley says June 8 is its base case for X-date, when the Treasury runs out of sufficient cash.

Representative Chip Roy of Texas called the default warnings a “manufactured crisis” to force Republicans to step back from some demands.

“The fact is, we’re going to have cash in June,” Roy told reporters Tuesday.

“The fact is, we’re not going to default on our debt. That’s just completely false. We’ve got the money to do it.”

Politicians gonna politic… and to anyone that believes we get a deal without the market crashing and forcing them to the table, we wish you luck.

Tyler Durden

Tue, 05/23/2023 – 14:33