What A US Default Would Mean For The Repo Market

Two weeks ago we published a lengthy report looking at the hypothetical consequences of a US default – including “Clearinghouse Collapse And Shockwave Of Catastrophic Treasury Margin Calls” – which again are purely hypothetical: as we first said last week…

As a reminder, the US can not default: tax receipts are more than enough to cover debt maturities and interest. Those 25 million govt/deep state workers and Ukraine wire transfers may not be so lucky though.

— zerohedge (@zerohedge) May 16, 2023

… and as Stifel’s Brian Gardner confirmed just a few days later…

Federal revenues cover only 75 percent of outlays so at some point, without an increase in the debt limit, Treasury will be unable to pay all of the government’s bills. It seems clear that Treasury will prioritize the payment of principal and interest on U.S. Treasuries, so the chances of a default on Treasuries is remote. Also, it is unfathomable that the government would not pay Social Security recipients or meet payroll of the American military. On any given day, however, Treasury would likely have to delay payments of some obligations. Depending on who the creditor is (a government contractor, veterans’ benefits, other social safety net payments, etc.), delayed payments would likely increase political pressure which would, in turn, increase the chances of reaching a debt ceiling deal, but would also be accompanied by some economic disruption and possibly a downgrade in the credit rating of U.S. government debt.

… because despite all the posturing, the US can and will prioritize debt and interest payments and avoid a technical default, even if it means that some 20 million deep state bureaucrats go unpaid for a week or two.

But since we are dealing with hypotheticals, below is a quick snapshot courtesy of Curvature Securities’ analyst Scott Skyrm who looks at what the impact of a US default (again, purely hypotehtical) would be on the repo market.

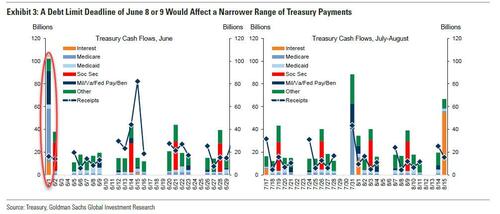

As Skyrm explains, in the Repo market, the debt ceiling dynamics boils down to the fact that no cash investor wants to hold a defaulted Treasury as collateral. As a result, cash investors will pull their cash from the market as the drop-dead date approaches, which according to Janet Yellen may be as soon as June 1, for the simple reason that there is a massive $80 billion net cash outflow from the Treasury on that day, one which tips the cash balance into the red.

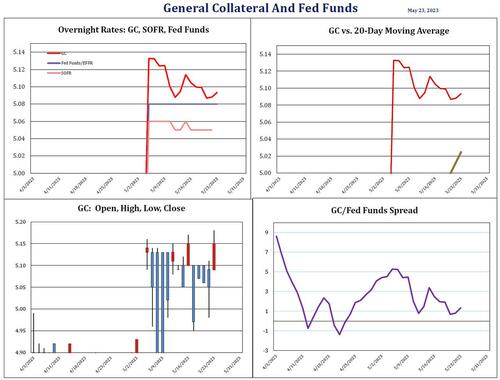

Going back to the repo market, ahead of a potential X-Date, cash investors who pull their money from the repo market will move to the fed funds market or into Money Market Funds. Even more cash will then flow into the Fed’s RRP facility, sucking up liquidity from the market.

When cash leaves the Repo market, there will be a spike in funding pressure, and overnight rates could move to the top of the target range – trading around 5.25%-5.30%.

While not there yet, Skyrm observes that the Repo market is starting to feel the effects of cash leaving. Term GC bids are thin and rates continue to tick higher each day.

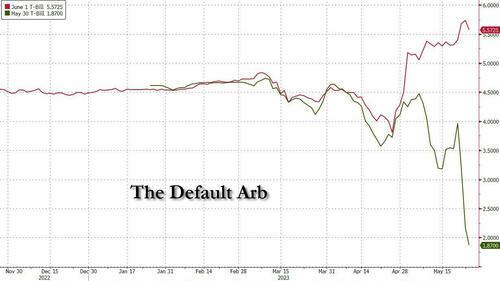

Meanwhile, no one will accept short-dated bill collateral for term trades. This is why there is now a record, gaping chasm between Bills maturing on May 30, and those maturing just 48 hours later, on June 1 (or, rather, not maturing).

Also, customers have sold so much term collateral though June, July, and August that there are few bids left and they’re all substantially higher than just a few days ago.

Yet, curiously, given the technical default issues with early June bills, one would think they would have substantial shorts. That’s not the case, despite the unprecedented divergence in May vs June bills. In fact, all of the early June bills are trading between 5 and 10 basis points below GC.

Then, of course, who is willing to short-sell bills trading between 50 and 100 basis points above GC? What happens if you are right, and the US does default. Good luck getting paid on your shorts…

Tyler Durden

Tue, 05/23/2023 – 22:45