Debt Ceiling Doubts Skyrocket; Everything Sold

Ugly inflation data in the UK was shrugged off by BoE officials (who likely don’t suffer from the cost of living crisis), but overall, today was thin on economic data and fat on economic crisis potential as markets woke up to the reality that the idiots in Washington are going to take this down to the line (or even just maybe cross it).

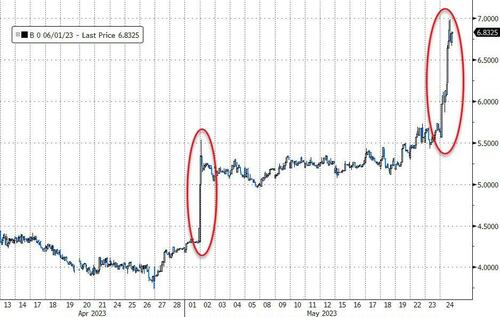

June 1st T-Bill yields exploded above 7% today,

Source: Bloomberg

…sending the spread to 5/30 bills to a mind-blowing record high…

Source: Bloomberg

That’s a 430bps yield premium for 2 days (theoretically) more maturity.

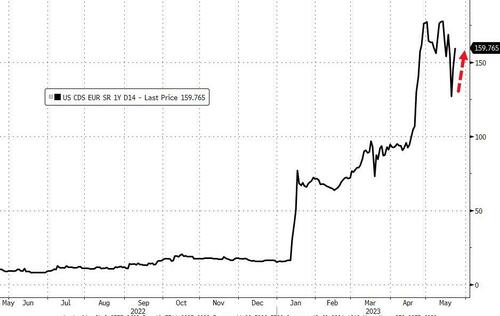

USA CDS spiked back near record highs again…

Source: Bloomberg

That level of anxiety appeared to finally trigger some cash-hording as everything was sold at the margin…

Stocks were dumped with Small Caps hardest hit (as financials were sold). With an hour to go in the day, ahead of NVDA’s earnings, markets decide to go panic bid

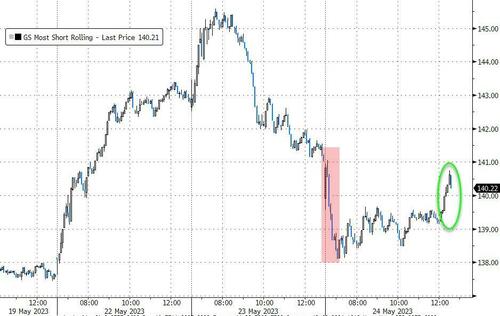

We note that 0-DTE players tried to spark a rebound twice today (and succeeded in the late one)…

The 0-DTE move triggered enough squeeze action in ‘most shorted’ stocks…

Source: Bloomberg

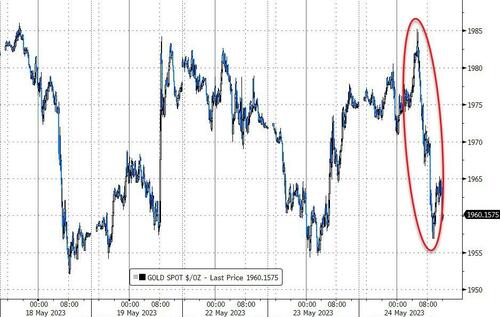

Gold was puked back to recent lows…

Source: Bloomberg

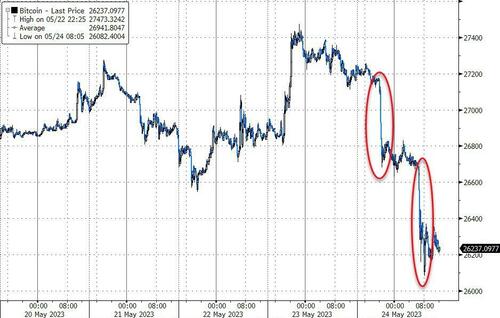

Bitcoin was battered again back near $26,000…

Source: Bloomberg

Bonds were hit too after solid gains overnight. The belly was worst (3Y-5Y +5-6bps) while short- and long-ends were up around 2bps on the day…

Source: Bloomberg

But, despite plenty of vol, oil managed some gains after Saudi comments yesterday and a huge crude draw today…

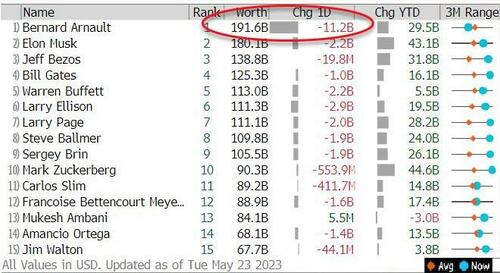

Finally, if you think you had a bad day, consider Bernard Arnault – the world’s richest man still – who lost over $11 billion (and more today) in the last couple of days…

Source: Bloomberg

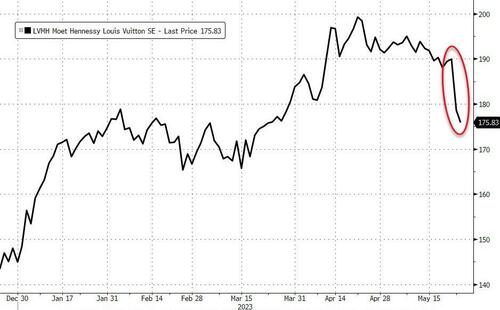

As the luxury bubble looks like it just burst…

Source: Bloomberg

Somebody do something!!!

Tyler Durden

Wed, 05/24/2023 – 16:00