This text was initially revealed by Tyler Durden at ZeroHedge.

(Replace: 1055ET): Treasury Secretary Janet Yellen stated on Wednesday that indicators of market stress are starting to emerge because the X-date attracts nearer, nonetheless, the Biden administration is not making ready for a default, and is as a substitute specializing in finishing a debt-limit deal.

“We’re dedicated to not having missed funds and elevating the debt ceiling,” Yellen stated at a video convention occasion in London. “We’re not concerned in planning for what occurs if there’s a default,” she stated when requested if Treasury was engaged with main banks to map out a default state of affairs, Bloomberg reviews.

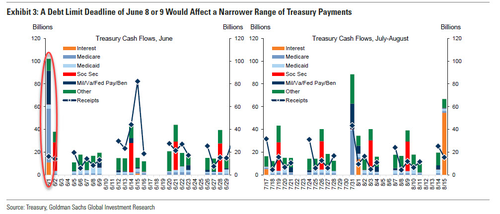

“It’s extremely probably that we’d run out of sources to fulfill all the federal government’s obligations in early June and probably as early as June 1,” she instructed the convention. “We now not see very a lot chance that our sources will allow us to get to the center or finish of June.”

In the meantime, Home Speaker Kevin McCarthy will present an replace on negotiations at 11:45 am ET.

* * *

With (arguably) simply eight days to go earlier than the US authorities enters potential default territory on greater than $31 trillion in debt, the standing of negotiations between the White Home and members of the Home GOP’s negotiating crew – Reps. Patrick McHenry (R-NC) and Garret Graves (R-LA) are telling allies on Capitol Hill that talks have oscillated between optimistic and completely crumbling.

“There’s a important hole between the place we’re and the place they’re on funds… and except and till the White Home acknowledges that it is a spending drawback, we’re going to proceed to have a big hole,” Graves stated on Tuesday, Punchbowl News reviews.

Speaker Kevin McCarthy and his negotiators repeatedly have warned the White Home {that a} deal gained’t be attainable except they comply with lower spending subsequent yr.

The White Home, for its half, has tried to safe some Democratic wins with out success. Administration officers regarded to shut tax loopholes and broaden prescription drug value negotiations for Medicare, however they had been rebuffed by Republicans.

White Home officers additionally supplied a spending freeze at FY2023 ranges. McCarthy stated that’s not a compromise he’s desirous about.

The GOP negotiators are pinning the blame immediately on the White Home for not empowering Democrat negotiators Steve Ricchetti – a Biden counselor, and OMB Director Shalanda Younger.

“The abilities of the those who the administration despatched within the room, they understand how to do that. If they’ve the constraints from the administration and the directive which you can’t spend much less — that’s coming from the highest degree of the White Home. And in the event that they’re making that as a play name, they’re utterly misreading the state of affairs in a really harmful approach,” stated McHenry.

The central pillar of the debt ceiling debate is shaping as much as be “discretionary spending” – the quantity of the US’s roughly $6 trillion annual funds that’s set by Congress. Cuts to applications that represent a lot of the US funds – Social Safety and Medicare – are already off the desk, nonetheless, a spread of different army and home objects are topic to reductions.

In 2022, discretionary spending reached $1.7 trillion, accounting for 27% of the general $6.27 trillion spent, in accordance with federal figures.

Army spending sometimes accounts for roughly half of that complete, although the quantity varies from yr to yr.

The opposite half is dedicated to home applications like law enforcement, transportation, housing and scientific analysis.

Discretionary spending as a share of U.S. gross home product peaked within the late Seventies, and cuts have served because the spine for a number of landmark funds offers because the Eighties. –Reuters

Biden and the Democrats have supplied to maintain discretionary spending flat from the present 2023 fiscal yr, together with a cap in spending in future years. Home Republicans, in the meantime, handed a plan final month which might cap development at 1% per yr for a decade, saving $3.2 trillion. In accordance with GOP negotiators, they gained’t settle for any deal except it ends in the federal government spending lower than it did final yr – ideally chopping issues to 2022 ranges.

Republicans need spending caps for six years, whereas the White Home solely needs two.

Proper now, Social Safety and Medicare account for roughly 37% of present federal spending, with the previous projected to extend by 67% by 2032, and Medicare practically doubling in value over the identical interval. Due to this, deep cuts will probably be required in different areas of the funds.

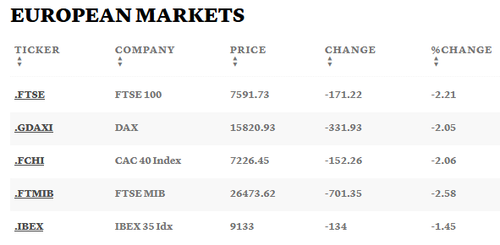

The debt ceiling debate has spooked European markets, with the Stoxx 600 index down 1.8% at 2 p.m. London time and practically all sectors down over 1%. Autos, banks, insurance coverage and journey shares all shed over 2%, CNBC reviews. And whereas the deadlock in Washington DC continues, US Treasury Secretary has warned lawmakers that it’s “extremely probably” that the so-called “X-date” for default will occur in early June.

In the meantime, Asia-Pacific shares adopted Europe, and the US market isn’t trying nice out of the gate on Wednesday – with the Dow Jones Industrial Common pulling again by no less than 229 factors (0.7%), the S&P down 0.8% and the Nasdaq shedding 0.9%.

Even when Washington officers increase the debt ceiling, markets might undergo because the impression probably removes liquidity from broader capital markets, stated Invoice Merz, head of capital markets analysis at U.S. Financial institution Wealth Administration. That’s as a result of the Treasury might want to difficulty a whole lot of debt to replenish its normal account, he stated.

“Particularly extra just lately, [that] has actually overlapped with, or it has correlated with, S&P 500 basically inventory efficiency,” Merz added. –CNBC

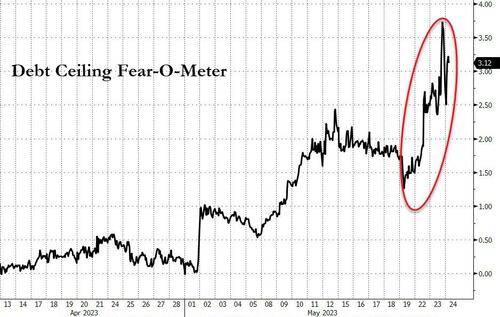

Wanting on the unfold between the Might thirtieth t-bill yield and the June 1st yield – yields the next:

On the finish of the day, as we stated two weeks in the past…

As an alternative of all of the breathless apocalyptic commentary on a US default, can we simply agree on how a lot shares should drop to get a deal executed in Congress

— zerohedge (@zerohedge) May 11, 2023